Please don’t kill me for the lack of creativity in that title. I was trying my best….Anyhow, here are some things I think I am thinking about:

1 – DIVERSIFY! Here’s a Wall Street Journal piece about a 15 year old “activist” investor in Bank of America stock. This young lady was gifted 5,000 shares of Bank of America when she was a baby.¹ And the stock has done almost nothing since then. In fact, it’s a bit negative over the last 15 years (by a “bit” I mean 20%). So now she’s mad and she’s attending all these shareholder meetings trying to get management to get the stock price up. Except, she shouldn’t be wasting her time doing this at all.

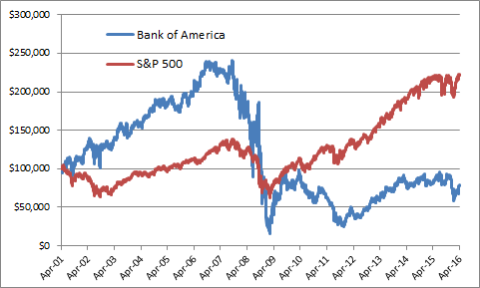

You see, this article wants to glorify some smart young lady who’s being an “activist” investor, but the real lesson here has nothing to do with activism or smart 15 year olds. The real story is one of diversification. Had her parents diversified her portfolio into something like the S&P 500 she wouldn’t be wasting her time worrying about shareholder activism because her $95,000 in BAC stock (share price was about $19 on April 27th, 2001) would be worth about $220,000 as opposed to $75,000.

Diversification is one of the most basic lessons in investing, but it really can’t be repeated enough. If you want to help your children avoid the plight of having to attend useless shareholder meetings then do yourself a favor and read my free paper on Understanding Modern Portfolio Construction.

2 – Endowments are Bad at Spending Money. Here’s Felix Salmon being very mad at Larry Summers and the Harvard Endowment fund for not spending enough of their $40 billion endowment. Summers basically says that Harvard should prepare to spend less of its endowment every year because future returns are likely to be lower. Salmon says that the endowment should think long-term and not allow this sort of short-termism to get in the way of the real purpose of the endowment which is to spend at a rate that maximizes long-term ROI towards the University as opposed to worrying about maximizing the fund’s internal ROI.

I have some sympathy for both arguments, but I probably lean a bit in favor of Felix here. Endowments are tax free entities that serve the same basic purpose as a charity. People give these funds money and they’re expected to spend that money in a manner that improves the long-term ROI to the University by improving the overall quality of life at the University. But for some reason these endowments are all in some weird rat race to become the biggest and best investment fund. This short-termism doesn’t reward anyone except the reputation of the asset manager who runs the fund. And yes, endowment returns are important, but the ROI on the actual fund is far less important than the ROI on the dollars spent from that fund. I think endowments should spend more time thinking about how to spend their money wisely and less time worrying about how well they stack up to Wall Street’s floundering hedge fund masses….

3 – The World Needs more US Government Debt! Here’s a very sensible piece from Narayana Kocherlakota, someone whose name, no matter how many times I type it, will never get easier for a pea brain like me….The former president of the Minneapolis Fed says we need more US government debt. Kocherlakota says the world needs more safe assets and since US T-Bonds are the world’s safest assets then the US government should step up to the plate and issue more of them.

This strikes me as a very sensible idea. Of course, you have to be able to get over the nonsense about the USA being bankrupt and all that, which isn’t easy. But once you realize that’s a misguided belief then Kocherlakota’s thinking becomes pretty smart. My thinking on this is rather basic. The world is stuck in a situation where aggregate demand is too low and inflation appears to be on the verge of a perpetual deflation. That’s largely because balance sheets are weak following the great deleveraging of the housing bust. If the US government spends more then the private sector obtains a net financial assets which improves balance sheets and should lead to more spending which leads to more corporate revenues which makes everything better.

Why is fiscal policy so powerful? Well, you asked the right person. It’s because it results in a net financial asset for the private sector. You see, when the government deficit spends a dollar into the economy it obtains that dollar from Peter who gets a bond in exchange. Peter has a risk free interest bearing asset and has passed on a dollar he probably would have saved anyhow. And the government takes Peter’s dollar and gives it to Paul who likely had to work for that dollar or will go out and spend it on something or pay down some debt with it. But in total, what we have here is a new asset in the private sector (the T-Bond) with no corresponding liability (the T-Bond is a liability to the non-government). So, Peter gets a bond which pays him interest income, Paul gets the income from the government and the private sector gets a net financial asset which should make balance sheets healthier. And if the government spends that dollar on something productive in the process of paying Paul then we might even get a great big multiplier effect.

So, I’ll ask again – if this all seems like such a no-brainer then why haven’t we done it yet?

¹ – I’ve apparently reached that age where it is only appropriate to call young girls “young lady”. I will find the closest bridge and promptly propel myself off of it.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.