Sorry to go AWOL over the last few days. Life got in the way. And yes, I have one of those life things despite claims that all I do is write and talk about economics and finance. Anyhow, here are some things I think I am thinking about:

1 – Venture Capitalists are bad (not)! Here’s a piece in the WSJ about Marc Andreessen’s venture capital returns. Basically the article argues that the firm’s returns aren’t that good because, well, they were only in the top 95% of returns:

“The earliest fund, raised in 2009, ranks in the top 5% of venture funds from that year; the second fund, raised in 2010, ranks in the top 50%; and the third from 2012 ranks in the top 25%.”

You know, Tiger Woods also lost a few hundred golf tournaments over the years. I can’t believe he was so terrible at golf! Talk about high expectations! What’s more worrisome is that VC’s are starting to get the hedge fund treatment. By that I mean that VC’s are starting to get treated like high fee leaches on the financial system where we criticize them for the most mundane things. I think we have to be careful here. VC’s are financing firms. Many hedge funds (not all) are just fancier sounding versions of high fee closet indexing mutual funds. They really are a leach on the financial system. But most VC’s are taking huge risks to provide early stage companies with capital necessary to grow. They aren’t just a useful part of the capitalist machine, they are a necessary part of it.

2 – Indexing and Communism. Speaking of capitalism – here’s a wonderful piece by Cliff Asness in defense of indexing in response to this piece by Bernstein that compared indexing to, um, communism. Yes, they made that leap. They must be excellent jumpers over there at Bernstein. The Bernstein piece was titled “The Silent Road to Serfdom: Why Passive Investing is Worse Than Marxism.” Oh crap. You can see where I am going with this….

This is a big problem in financial circles. Because we don’t consistently define “passive” we just sling the term around like it’s meaningless. The reality is that, in a strict sense, there is no such thing as passive investing. There are only varying versions of active investing. I’ve written with much clarity on this issue (see here). And the thing is, “passive indexing’ isn’t this homogeneous thing. In order for some investors to be less active others must be more active. The more “passive” indexing there is, the more there’s a need for more active investors. You literally cannot have a functioning market of purely passive investors who do nothing. You need the active market makers and arbitrageurs to make the passive side work in the first place. And yes, those passive indexers pay unseen costs in exchange for this.

Here’s an analogy to make this more concrete. What indexers do is buy financial assets in bulk. In doing so, they get a discounted price. Can you imagine if we called bulk buyers of goods and services “communists” because they buy lots of things at once and then stock them in inventory for a very long time? No, that would be ridiculous, but that’s the equivalent of what’s happening here all thanks in large part to the myth that passive investing is even a thing….Sometimes I wonder if economics and finance isn’t made up of totally arbitrary language designed to sell things and confuse people rather than provide clarity about how things actually work….

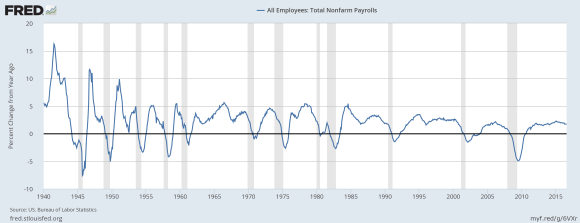

3 – Jobs and the Fed. There was a new labor report out this morning and boy was it a snooze fest. Basically, we added 151K new jobs. The last report was revised higher by 20K so we missed the net consensus of the two months by a little. Big deal. People will make a big fuss over what the Fed will do with its next measly 25 bps rate move, others will complain that the economy is teetering into the abyss, etc etc. Honestly, we should all be thankful that we’re now 7 years deep into a recovery and the labor market is still growing.

It’s crazy, but with the exception of the 1960’s and 1990’s this job market recovery is turning into one of the longest on record. And yet there seems to be nothing but gloom and doom surrounding every discussion about jobs….

Oh well, I have some more life stuff to get around to, but I promise I won’t leave you for that long ever again. Until I die of course. Then you’ll be done with me once and for all and you can stop hearing me rant about the same things over and over again. Hopefully that won’t happen for a little while because I feel like I still have some good rants to contribute to this world.

Have a wonderful holiday weekend. Be safe out there East Coasters!

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.