Gawker, market crashes and the most hated stock market rally….

1 – Gawker, Gawker, Gawker. One of the more interesting things occurring in the world of free speech is the controversy over Gawker and the Hulk Hogan lawsuit. In case you didn’t know, Gawker posted a video of Hulk Hogan having sex without his permission. Gawker was sued and argued that the video was in the public interest which should be protected under the first amendment. Gawker lost. By a lot. Then the news broke last week that billionaire Peter Thiel was funding the Hogan side. Thiel was on the wrong end of an attack by Gawker who outed him as being gay long ago. And now billionaire Pierre Omidyar is trying to help fund Gawker’s appeal.

As a part-time writer, but not a journalist, I feel like I have a strong view on this matter. After all, I expect to be able to write things, sometimes critical of other people, without being sued. But I think there has to be a certain standard of ethics in how this is done. I have made a strong commitment to write on this site without personally attacking people (I will only attack ideas, never a person) and I try to objectively analyze the economy and the markets so as to avoid the click bait type of analysis that I know would drive much more traffic to the site. I am not trying to win viewers. I am trying to provide real value with objective analysis and not fear mongering type bull shit.

I think this is an important view because a lot of mainstream media has lost its way in the search for eyeballs. Click bait and sensationalism has become a real problem. And the Gawker lawsuit is just a case of the sensationalism coming to a boil. After all, Gawker is the type of website that will post videos of a woman allegedly being raped and then respond to the same woman by telling her not to overreact to the publicity. They like to call this reporting “news”, but that is probably generous. They post some actual news, but they make their money posting sensationalism that no one really needs to know about.

In the Hogan case, this was a clear invasion of privacy and looks very similar to revenge porn. In other words, this isn’t even a first amendment case. It is an invasion of privacy case. And that’s the problem with a lot of online media these days. We are living in an age of low journalistic ethical levels all in search of page views and ad revenues. Personally, I think Gawker broke the law and I think the media should be held to a higher standard of ethics. We’re walking a slippery slope here and I think it’s time for the media to halt the sharp slide in content quality that has occurred in the endless battle for ad revenues. As for Peter Thiel – really, who cares? Billionaires have always controlled the media and will always influence the way politics and media are influenced. I don’t think his introduction here changes anything. Besides, there’s always another billionaire to take the other side of something like this if people really care that much anyhow….

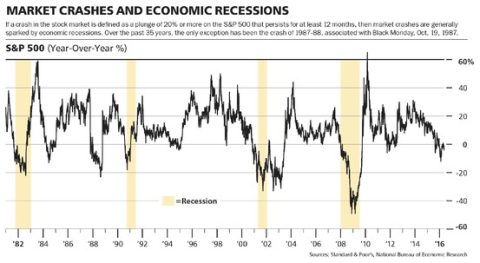

2 – Market Crashes and Economic Recessions. Nice chart here from Barrons showing how the market tends to undergo its largest declines inside of recessions. We should remember that the stock market isn’t the economy, but the stock market tends to react worst when the economy is at its worst. In other words, most of the time the stock market is gyrating up and down trying to predict future cash flows and usually overreacting in the short-term to perceived macro weakness. But the stock market has an asymmetric correlation with the economy and the economy can pull the stock market into a traumatic downturn.

This is one reason why I’ve always liked the idea of a regime switching strategy. That is, if you could construct a model of the economy to predict recessions you could create a very simple passive indexing strategy which operated within two regimes – one for expansion and one for contraction. It would be highly tax efficient and fee efficient, but it would obviously require some timing. And oh yeah, you need to be able to predict recessions which isn’t easy….So far, a recession model like mine has operated very well and would have operated in a “bullish regime” over the last 6 years….

3 – The Bears are Out in Force! I wrote a short piece last week explaining why the S&P 500 was near new highs despite all the seemingly bad news in the world. And like I do sometimes, I make the mistake of reading internet comments on the articles I write. In the case of the Seeking Alpha post the comments ranged from mildly insulting to bearish to very bearish. I should probably update my thinking given this response:

“The reason the S&P 500 is approaching all-time highs is because very few investors actually trust the rally in stocks and believe impending doom is right around the corner.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.