Here are some things I think I am thinking about:

1) China’s Black Box is Unleashed on the World. A thought that has me feeling increasingly uncomfortable is the reality of a world where China’s the most important global economy and no one knows what the hell is really going on there. I’ve spent years studying Chinese economic data and trying to better understand their economy and I feel pretty lost most of the time. There will be lots of people who claim they “predicted” the current China meltdown, but the reality is that people have been predicting doom in China for years. And no one really knows what’s going on because the Chinese government isn’t very transparent about what’s going on.

So, what do we know? We know China’s economy has probably been slowing for 3-4 years. Even the official Chin ese GDP figures are consistent with a slowing rate of growth. And we know this has resulted in a fairly steady slowdown in emerging market growth. Commodities have basically been in decline for this entire period and Europe and the USA haven’t exactly helped matters as the European economic situation remains mangled by the common currency flaws and the USA has been crawling out of its own debt bubble. So, the story hasn’t been all that happy anywhere in the world.

ese GDP figures are consistent with a slowing rate of growth. And we know this has resulted in a fairly steady slowdown in emerging market growth. Commodities have basically been in decline for this entire period and Europe and the USA haven’t exactly helped matters as the European economic situation remains mangled by the common currency flaws and the USA has been crawling out of its own debt bubble. So, the story hasn’t been all that happy anywhere in the world.

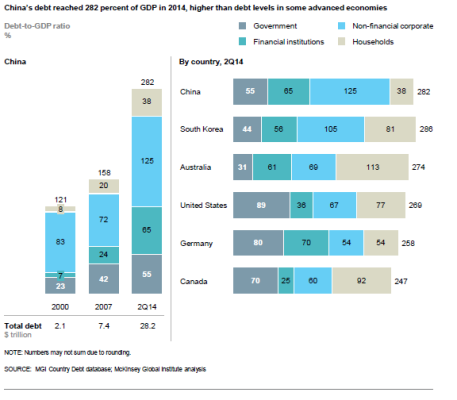

While the USA and Europe were deleveraging China was releveraging. In fact, their total debt to GDP nearly tripled in the last 15 years from 121% to 282%, but this isn’t exactly unique. They’re in good company around the highly indebted globe. We also know that Chinese real estate has boomed and has since slowed quite a bit. It looks a little bit like a replay of 2008 or 1998, however there are two big differences here: 1. 2008 was really a Europe and USA credit bust in which there was truly no place to hide as 50% of global GDP was the driver; 2. 1998 was an emerging market crisis in which a lack of foreign reserves and currency pegs played a central role. So, this is pretty different no matter how you slice it and I doubt it’s nearly as traumatic.

So, the question then becomes – how interconnected is China to everything else. No one knows precisely. The one thing we do know is that China is only about 5% of S&P 500 revenues and 1998 didn’t come close to derailing the US economy. Is it different this time? I don’t know. And I am not sure anyone knows how far China’s slowdown will reach. And the opaqueness of the Chinese economic environment might just be the scariest thing about all of this.

2) Is the Fed About to Ease? Ray Dalio released a note yesterday saying that the Fed is more likely to ease than tighten. That sure looks like the increasing probability here. The emerging market turmoil is a total game changer in recent months. It doesn’t matter how strong the US economy looks now. The Fed should err on the side of caution. The prudent thing to do would be to announce (in the coming days preferably) that a rate hike is likely to be delayed into 2016. The last thing the Fed wants to do is exacerbate the dollar rally and commodity collapse. The nice thing about the Bernanke Fed was that it was super transparent and communicated with markets very effectively. Yellen needs to come out of hiding and eliminate the uncertainty hanging over the September meeting. The sooner the better. Markets and economies would applaud the move.

Are we on the verge of QE4? I don’t know about that. One interesting idea that was passed about here on Pragcap was the potential for a rate hike combined with an increase in QE. This would potentially kill two birds with one stone. The more I think about that the more I think it would send mixed messages. I think the Fed needs to be clear about what they’re doing in the coming quarters. For now, it’s probably best to delay the rate hikes and sit tight. No need to panic one way or another.

3) The Chinese stock market is shoddy. We could probably all use a good laugh right about now so here’s a classic from The Onion:

SHANGHAI—Proving to be just as flimsy and precarious as many observers had previously warned, the Chinese-made Shanghai Composite index completely collapsed Monday, sources confirmed. “Sure, it looked fine from the outside, but anybody who saw it up close knew that it was of such poor quality that it wasn’t built to last,” said Allen Sigman of the London School of Economics, adding that the stock market, which he described as a crude knockoff of Western versions, was practically slapped together overnight and featured countless obvious structural weak points. “They pretty much ignored regulations, and inspections were a joke. The only surprise is that it didn’t fall apart sooner.” Sigman added that he just hopes there weren’t too many people who were hurt in the disaster.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.