Three things for Thursday. Well, it’s Wednesday, but I’m already thinking about tomorrow so I guess I am a step ahead of you. Okay, that’s not true. I just lied to you. But Three for Thursday sounds better than Three for Wednesday so let’s just go with that, okay?

1) James Altucher says you shouldn’t own stocks. Last month James said you shouldn’t invest in a 401K. That was dreadfully incorrect advice and thankfully there were a lot of people who pushed back against it. I love James, but I have to say that this is almost equally bad advice. Let’s explore this idea more fully.

Instead of owning stocks James says you should invest in yourself or in hedge funds:

The best way to take advantage of a booming stock market is to invest in your own ideas. If you have an extra $50,000 don’t put it into stocks. Put it into yourself. You’ll make 10,000% on that instead of 5% per year.

But if you are a bit older and don’t feel like starting a company, it’s ok to find the right hedge fund managers and follow the stocks in their public filings whenever they take a big position.

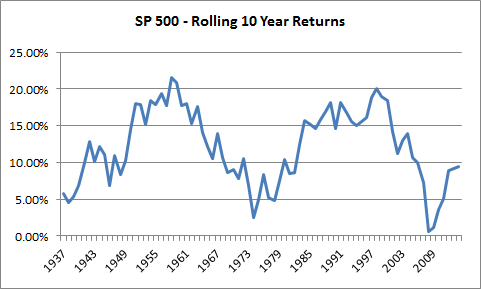

That’s very strange. There is virtually nothing more risky than starting your own company. Yes, there is huge potential upside, but 67% of new businesses fail within the first 10 years.¹ When was the last time the S&P 500 lost even a dime on a rolling 10 year basis? NEVER.

More importantly, you have to leave your savings somewhere. Most of us need some savings to plan for life’s big events in the future. And the best way to protect that savings is to build a diversified portfolio of stocks, bonds, cash, etc. After all, if you invest only in start-ups you’ll excessively expose yourself to the risk of permanent loss. And if you take no risk and leave your savings in cash then you’re overexposed to the risk of purchasing power loss. A diversified portfolio can balance these risks so that you can increase the odds of having a certain amount of savings at points in the future. I would agree with James if he said you shouldn’t invest all of your savings in stocks, but that’s not what he said. He said invest it in a start-up, but investing in start-ups is hugely risky!

What about high priced hedge funds? Well, it depends. I am not ideologically against hedge funds, but I’ve audited a lot of hedge funds over the years and it’s safe to say that they’re very similar to closet index mutual funds. That is, about 80% of them are doing something that won’t outperform index funds, but will charge very high fees for it. As for rummaging through quarterly filings? Call me a skeptic. Study after study shows that chasing hot shot hedge fund managers is a lot like believing that the guy who just flipped heads 10 times in a row has a truly unique and repeatable talent. The reality is that most hedge funds are vastly overpriced and the ones that aren’t overpriced are impossible to get into. There’s a time and a place for strategic asset allocation and Vanguard has found that a smart advisor and asset manager can add up to 3% to your returns per year. But you shouldn’t pay an arm and a leg for that.

The bottom line – you should just about always hold SOME stock market exposure (preferably via low fee index funds). The stock market is an essential piece of a well diversified portfolio and it’s only as scary as you make it. A properly constructed savings portfolio is an essential piece of protecting your financial assets. If the stock market scares you then you’re almost certainly taking more risk than you’re comfortable with and that can usually be resolved with a proper risk profiling and proper diversification. Allocating your savings doesn’t have to be so scary and don’t let articles like this one scare you entirely out of the financial markets.

2) Peter Schiff and Jim Rickards say gold hasn’t actually lost any value! Bloomberg aired an interview with Rickards in which he claims that gold hasn’t lost value:

“You say gold has lost X%, 70% of its value. To me, gold hasn’t lost any value. What’s happened, is the dollar has gotten stronger. So if the dollar is the measure of all value, then yes, gold is down a lot… But make gold the measure of value and ask ‘What’s really going on?’ A dollar used to get you a fourteenth-hundred of an ounce, today it gets you an eleven-hundredth of an ounce. You get more gold for your dollar. This is really a strong dollar story.”

We should be clear about this point. We price things in dollars because the dollar is the currency with which US goods and services are priced. They’re not priced in gold. You don’t walk into Wal-Mart and see things labeled “TV for sale for 12 ounces of gold!” or “TV for sale for 2 shares of AAPL!” We live in a monetary system in which things are denominated in US Dollars. So, James was dead on when he said:

“the dollar is the measure of all value, then yes, gold is down a lot”.

The bottom line is that gold has lost huge amounts of value relative to any fiat currency. The dollar is the measure of all value. So yes, if you own gold you really have lost money in the last few years. Moving the goal posts at this point isn’t going to bring your money back. And unfortunately, the people who got rich from the gold boom were the ones running gold companies selling you gold in exchange for…US Dollars – the asset they said would collapse in value.

3) Paul Krugman is sick and tired of the Euro apologists. I guess that makes him sick of me. Actually, he probably doesn’t care about me (sad trombone). But in all seriousness – what’s up with these progressives who are in favor of a totally regressive roll back of the Euro? You’d think that someone like Paul Krugman, who’s the target of many a “socialist” attack, would be in favor of more socialism in Europe. But no, he’s not. Instead, he says it’s been an epic failure that needs to be scrapped.

I just don’t understand this mentality. Look, Europe isn’t getting any smaller in the future. As technology and globalization expands these countries are going to feel increasingly on top of one another. Further political and economic unity isn’t just necessary. It’s totally inevitable. The creation of the Euro is simply the natural progression of a shrinking economic region. And of course there will be difficulties bringing dozens of countries with thousands of years of animosity against one another, into a common currency that requires political unity. And we’ve seen some remarkable successes in the last 25 years. We should applaud the Euro for overcoming so much animosity in such a brief time (it took the USA hundreds of years and a Civil War to become fully unified). After all, if the Europeans can become politically unified with time then the Euro will work and it will not only be a great economic success, but it will prove to be a great human success. We should be encouraging Germany to embrace Euro unification instead of fueling the divide.

Rolling back the Euro at this point is a counterproductive and regressive policy approach. The Euro can work if Europeans want it to work. But that will require greater unity. Paul Krugman should act like a real progressive and realize that his regressive mentality is only fighting a natural trend for Europe to become more economically unified. And the cherry on top – what would make progressives like Paul Krugman happier than seeing Germany involved in a huge fiscal transfer system that takes from the rich and gives to the poor?

¹ – SBA FAQ

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.