Here are some things I think I have an opinion about:

1) Fat Shaming Works for Me. I liked this thoughtful Tweet by Dr. Mike Simpson:

I do not condone body shaming. But, as a physician, I also cannot condone people pretending that obesity is healthy. Beauty may be skin deep, but fat deposits go all the way to your internal organs. Be healthy, live well! pic.twitter.com/PJ4dN0E83g

— Mike Simpson, M.D. (@DrMikeSimpson) August 30, 2018

I’ve talked quite a bit about the economic and health epidemic of obesity in the USA. This is a problem that should not be downplayed. Now, I know this is a touchy subject. We don’t want to body shame people just because they don’t conform to some idealistic magazine cover image, but at the same time we need to have a really honest discussion about the fact that being obese is unhealthy.

Personally, I demand fat shaming from my wife. I need the honest and transparent feedback. This helps me stay motivated to live a healthier life. Having her lie to me to make me feel better about something that is dishonest does me no good. Of course, she doesn’t beat me with a whip or hurt my fragile ego as she’s “fat shaming” me. But there’s a balance between being honest about someone’s health and being conscientious about their feelings. We can have an honest discussion about this topic while also doing so in a sensitive and understanding way.

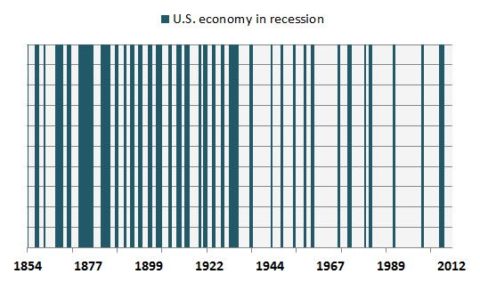

2) The Golden Era of Low and Stable Growth. I love this chart from Morgan Housel:

There’s been a lot of talk in recent years about “secular stagnation” and “liquidity traps” and “finanacial repression”, but no one ever seems to talk about the fact that the modern economic era is also one characterized by longer and longer recoveries and increasingly stable recoveries. Personally, I prefer low and stable growth over high and volatile growth.

3) Make Public Markets Great Again. Here’s a good piece by Dave Michaels in the WSJ about the SEC’s consideration to open private market placements to more retail investors. In essence they want ease the accredited investor rule so more investors can access private deals.

This strikes me as somewhat backwards. The reason private deals have a higher regulatory hurdle is because they are inherently opaque offerings that are more susceptible to fraud. At the same time, the public markets are shrinking in part because the government has made it excessively onerous to be a public company. So they’re now trying to correct that issue by making private markets more accessible instead of making public markets more accessible for corporations.

I don’t see how this makes sense. The reason the accredited investor rule works is because the people who get scammed in private deals are generally people who can afford to get scammed. The rule often gets confused to mean that the investor is “sophisticated”, but I think you start getting into murky water when we try to base the rule on qualifications. The AI rule is essentially a capital rule that assumes you have a buffer to absorb losses in the case of fraud. A qualification based rule opens the door to hurt people who might be qualified, but don’t have the financial stability to absorb potential fraud.

If we want to make markets more accessible then let’s focus on making it easier for companies to go public rather than driving investors into more dangerous and opaque markets that open them up to more potential fraud.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.