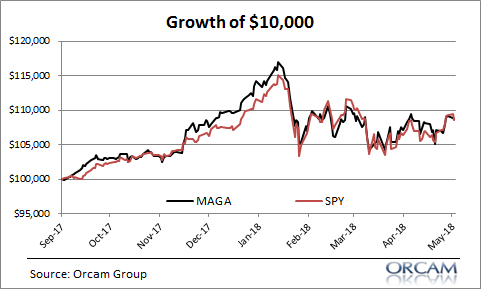

1) Investing and Politics Don’t Mix. I posted this chart on Twitter the other day – it’s the MAGA ETF. Basically, the index provider took companies that are highly supportive of Republican candidates. It’s kind of an interesting idea since we tend to think that Republican policies are better for the economy than what is generally perceived as more “socialist” ideas sometimes espoused by Democrats.

Anyhow, the interesting thing for me here is that this all comes down to stock picking at the end of the day. Can anyone pick the companies that benefit from “free market” principles better than other people can? My guess would be no because stock picking is damn hard and politics, while important, is less important than other factors that drive company performance (like innovation, etc). In other words, you can’t just grease some palms in Washington and expect to have companies that outperform. And that assumption would seem fairly accurate based on the performance of this ETF:

So, what you have here is a fund that sounds cute in theory, but is really just a version of the S&P 500. But the worst part about this story is that the owners of this fund basically just own a version of the S&P 500 that costs 0.72% per year when you could own it for virtually no fee. Yeah, politics and investing don’t mix….

2) Job Guarantees vs Universal Basic Incomes. There’s been a lot of debate in Lefty circles about UBI vs JG. It’s a weird discussion to be having given that the political atmosphere seems to be moving away from more government intervention in the economy. But the Left is convinced that it’s inevitable. Basically, as inequality persists people will feel increasingly left behind and will demand more action from the government. The most extreme versions of this debate on the Left veer into the JG vs UBI territory.

Now, I find these conversations interesting, but mostly a waste of time (sorry to those who don’t!). I’d be shocked if the USA adopted either of these policies in my lifetime. Especially given how much the partisan divide seems to be increasing. Neither side is getting anything too extreme any time soon. But it is an interesting thought experiment and maybe we’ll get to see it play out in some other country soon?

Long time readers might remember that I got involved in a bunch of these debates a long time ago when I voiced some of my disagreements with the MMT people. I wasn’t so concerned with the politics of the matter as I was concerned with the fact that the MMT people are just empirically wrong about the cause of unemployment.¹ So to me they were arguing that we needed a Job Guarantee based on a false premise. In other words, they were misrepresenting how the monetary system actually works and so they were coming to a false conclusion based on a misunderstanding of what actually causes unemployment.

Personally, I have never been against the idea of a Job Guarantee, but I’d probably side with the UBI people since it’s basically just widespread Social Security (which works well) and a JG is totally unproven on any grand scale. Plus, I think the government has proven that it’s better at mailing checks than providing people with productive employment. So yeah, a JG is a nice idea in theory, but something about it sounds too good to be true. MMT says that you can have full employment with price stability since the JG would provide full employment and serve as a price anchor. But this sounds like having your cake and eating it too. After all, if you give everyone a job with a living wage and full benefits then you’ll force the rest of the economy to compete at that same price point. This would look more like a price buoy than a price anchor. I could imagine inflation getting out of hand pretty quickly there.

Anyhow, Ed Dolan and Samuel Hammond offered up some really nice thoughts on the idea (see here and here).

3) Why Aren’t Wages Surging? More economic policy for you….Here’s Paul Krugman asking why wages aren’t surging if we’re near full employment. That’s a great question without a great answer. He gets deep into the weeds on the issue, but to me he’s overthinking all of this. After all, what’s the one big thing that stands out in the post-crisis era? To me it’s obvious – it’s basically a slow creep in inequality resulting in a massive disaggregation of credit that decimated the average household’s balance sheet.

Here’s how I see things:

- 1980-2000: rising inequality as we deregulate certain sectors and national income increasingly flows to the top.

- 2000-2008: boom in household credit as the housing boom takes hold.

- 2008-Today: personal consumption remains unusually muted thanks in large part to low demand for debt as the hangover from the credit bust persists and inequality remains high.

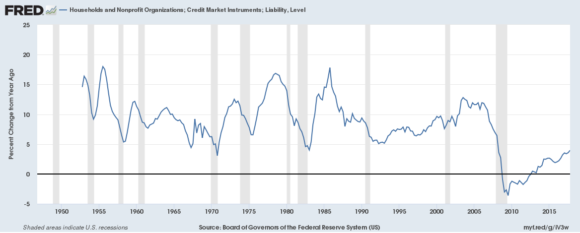

If you want to succinctly describe the post-crisis era I think this chart does a decent job:

So unemployment appears somewhat full, but aggregate demand is low because the demand for credit is weak because household balance sheets are still weak. Do we need to make it much more complex than that?

¹ – MMT argues that unemployment results from a lack of “net financial assets” issued by the government. Basically, they say the government is the monopoly supplier of net financial assets to the private sector and if the private sector can’t save enough then they won’t spend enough and then unemployment results. So they say deficit spend until unemployment is super low and mop up the residual with a JG. The policy idea might be decent, but unemployment is definitely not the result of a lack of government spending. The government’s deficit is a net benefit to the private sector that supplies supportive safe assets, but these assets are by no means a necessity. As Keynes rightly said, unemployment is caused by a lack of productive investment spending, which is the true driver of private sector net savings. MMT kinda makes a mess out of some of these issues by unnecessarily redefining well defined concepts (like net saving) in a weird attempt to make some of their newish ideas appear operationally consistent.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.