Here are some things I think I am thinking about:

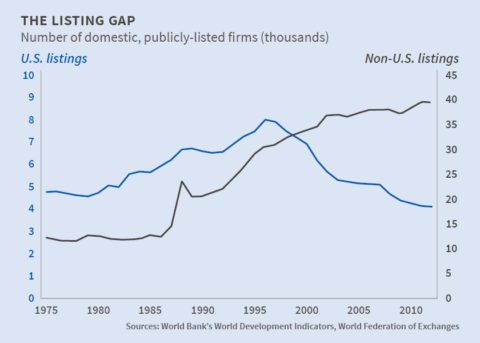

1) Shrinkage in the markets! There has been a lot of chatter lately about the shrinking of the public markets. This NY Times piece says the shrinkage is a problem for everyone. It cites this excellent NBER piece by people much smarter than me. Long story short, there used to be 8,000+ public firms and now there are just 4,000+ and so the world is about to go kaboom (or something like that).

It’s true, No one likes shrinkage. But shrinkage is perfectly natural. In this case I actually think the shrinkage is a good thing. Let me explain.

I do this thing sometimes where I trick my brain.¹ I believe that people always want to look at the world and find problems. We’re just hard wired to do that. For instance, we believe the stock market is usually wrong or politicians are usually wrong or the world is usually worse than it used to be. This might all be true, but what I try to do now is ask myself “what if this thing is precisely right for this moment in time?” It’s kind of an extreme efficient market and rational expectations trick that I play on my own brain. It’s not a nice thing to do to your own brain because it’s almost certainly wrong to some degree. After all, the efficient market hypothesis is pretty lame and I don’t know how it’s a thing. But it gets you to think outside the box at times.

Anyhow, while I was tricking my brain into this view I realized that maybe the size of the public market is precisely right. Maybe, just maybe, it was all wrong back in the 90s. Maybe that market was a bloated pig with way too many small and low quality firms that never should have gone public in the first place. And the data would seem to support this view. The decline is mainly the result of micro cap firms disappearing. In other words, they never got big enough to sustain themselves as public firms. In other, other words, the public market never should have been 8,000+ firms because there weren’t 8,000+ firms deserving of being public. So now we have just 4,000 firms, but they are larger more established and higher quality firms on average.

So maybe this isn’t bad at all? Maybe all that’s happened is the public market has turned into a smaller, but higher quality group of companies. In which case I say hooray! I’d much rather be allocating my savings to 4,000 high quality firms than trying to wade through 4,000 high quality firms and 4,000 low quality firms.

2) Why is positive inflation a good thing? Here’s a post by David Collum asking why positive inflation is considered a good thing. This is a really great question and there’s many Nobel Prizes to be won in the future for people who come up with the best answers. For now, no one really has a great answer to this question although there are many good answers.

Personally, I view inflation as the price we pay for higher living standards in a world of scarce resources with an elastic credit based money supply. So, regulars know that the “real” money supply in a developed economy like the USA is the deposit system which is the result of lending. Almost all of the money we use is credit based. That money is created from thin air when creditworthy borrowers have access to it. So, what we have in a healthy developed market economy is credit expansion which leads to people being able to buy more goods, invest in new innovations and all that good stuff. In the process of doing this we are consuming scarce resources AND expanding the money supply. But we are not worse off because of this. In fact, we are generally better off because of this.

For example, if I borrow $100 to buy an axe so I can turn a tree into a house then I am better off because of this since I now have a place to live. Of course, the value or price of that tree has just gone up because it’s become more valuable to any future buyer of it. There has been inflation in the local housing economy. But we are not worse off because of this inflation. We are better off despite it.

Now, there are bad types of inflation as well. For instance, what if someone decides to pay the same price for an existing tree as someone is willing to pay for my tree turned home? Well, that would be a bad type of inflation. There’s nothing rational about that. And yes, this happens all the time and is a rather basic explanation of what the housing bubble was.²

The Nobel Prize here is in the answer to why the bad types of inflation occur. The honest answer is that no one knows. We have lots of guesses (government spending, monetary policy, etc), but no one really knows for certain. My guess is there’s lots of causes and each inflation is its own unique event with its own unique causes. I’ll let you know if I ever figure out a simple answer though. Don’t hold your breath.

But the bottom line is that a low level of inflation is perfectly natural in a credit based economy. It doesn’t mean inflation itself is “good”. It just means that we are generally better off despite the inflation.

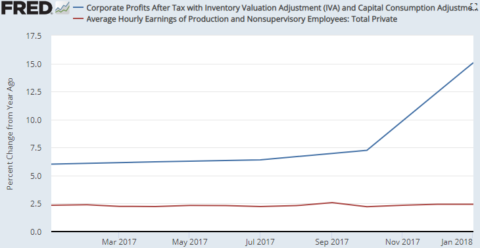

3) How is trickle down economics still a thing? There was a chart going around Twitter last week showing the boom in corporate profits relative to stagnant wages since the Trump tax cut was passed.

This isn’t really surprising at all. On election night I made three predictions – huge deficits, stock market rally and huge increase in inequality. All three of these are already happening and it’s not remotely surprising. But what is surprising is that Trump’s policies are leading to more inequality and people still believe the trickle down economic theory that supports those views.

Now, trickle down economics has been thoroughly debunked time and time again so I won’t rehash all of that. But it is quite amazing that we keep telling ourselves that if we just make corporations and rich people richer then somehow the rest of us will also get richer. The economy just doesn’t work like this and if you really want to solve the problem of inequality then you need to change your approach. Of course, I don’t think that a billionaire in the White House has any intent of trying to solve inequality, but you would think that the median American household making $60,000 would be concerned with this. Then again, asking the median American household to understand trickle down economics is probably a bit much to ask, but one can hope, right? RIGHT?

NB – In happier news here’s a video of me teaching my dog how to swim. I think she’s making good progress don’t you?

¹ – Yeah, yeah, I know, you probably think my brain is always tricked. Real funny.

² – Don’t come at me with an explanation of how housing is asset price inflation and not consumer price inflation. I know that. I just don’t entirely agree with the way the BLS calculates this since housing has elements of both investment and consumption in it. And while owner’s equivalent rent is a fine measure of housing inflation I think that it doesn’t fully capture short term prices changes in the things we consume in the real estate market.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.