I spend a lot of time talking about how the US government is not going insolvent. And while it’s true that changing to a non-convertible fiat currency system eliminated the risk of “running out of money” it didn’t eliminate the risk of currency collapse. Anyone who understands how the US monetary system is structured knows that the government will never have trouble procuring funds to meet its spending needs. But this doesn’t mean the government has no constraint at all.

Of course, the government is always constrained by the rate of inflation and the extent to which policy negatively impacts the economy through a real decline in living standards. So understanding that we can’t “run out of money” doesn’t mean we shouldn’t understand our true constraint. So that means we need an intricate understanding of hyperinflation, what causes it and whether or not it’s a real threat.

As Deutsche Bank recently highlighted, the move to non-convertible currencies didn’t eliminate sovereign crises. It just changed how they occur:

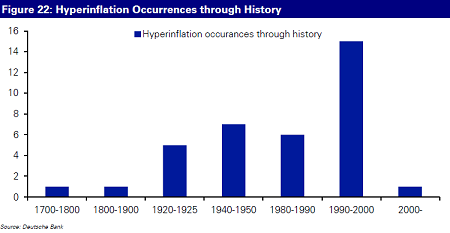

“Indeed at the more extreme end of the spectrum, since 1971 the number of recorded hyperinflations

seen throughout the globe has dramatically increased. Figure 22 counts such incidents seen through history in selected buckets.Although the hyperinflation list perhaps isn’t 100% inclusive, the trend is absolutely beyond dispute. The 1980s and 1990s saw the vast majority of the examples of these occurrences through history. Although all these have been outside of the developed world, this region has also seen many countries with high inflation over the period and with wide divergence between countries.”

So yes, in a way all we’ve done is change the TYPE of insolvency that occurs at the sovereign level. We haven’t eliminated it. But it’s important to note that hyperinflation is a very different phenomenon than insolvency or having a funding shortage. And perhaps most importantly, it’s helpful to understand that hyperinflation is more than a monetary phenomenon. Please read my section on hyperinflation for more on the true constraint and why it’s not currently a threat in the USA.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.