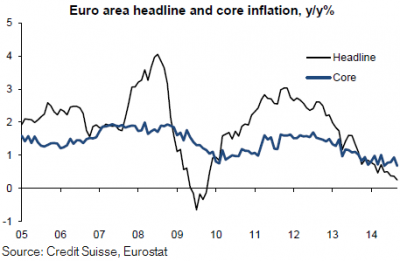

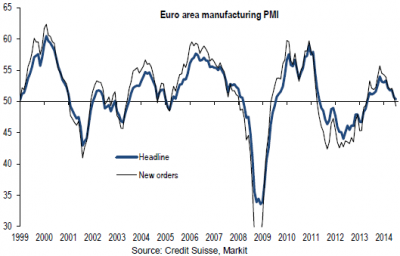

The recent economic data out of Europe continues to underwhelm. These two charts via Credit Suisse win the unsexy data of the day award:

I’ve stated that Europe looks much more “Japanese” than America does. And the reason is simple – their monetary system remains suboptimal. The incomplete monetary system has resulted in a permanent inadequacy of aggregate demand because the single currency system has no inherent mechanism by which it can rebalance its trade imbalances. And since the Germans refuse to allow a central Treasury to redistribute from the north to the south (as is done in the USA) then the south is in a state of near permanent decay. Ironically, this actually brings down the north because the north relies on the south for a big chunk of its exports.

So the story here remains the same. The European and global economies are being dragged down by silly policy decisions and an inability to recognize a design flaw in the Euro. They either need to make a push towards something more closely resembling a United States of Europe or they need to break up the whole thing and revert back to individual currency systems. One thing is for certain – the current system isn’t working well at all and something BIG needs to be done about it.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.