4 things you should read:

- Fed Director John Hilsenrath (also a reporter at the WSJ in his spare time): “Emerging Slump Won’t Stop Fed Taper, Yet”

- 2014: where valuations meet the road – Meb Faber

- 3 Popular economic myths – Morgan Housel

- Ben Bernanke’s Legacy – Stephen Williamson

1 Economic Data Summary:

- New home sales came in at 414K vs estimates of 445K. Some of this was due to the winter storms, but the housing market is definitely softening in the early part of 2014. The big price jumps from 2013 and inventory build look like they resulted in some near-term overcapacity and hesitancy on the demand side. It’s becoming a buyers market quickly.

- The Dallas Fed reported some slowing in the pace of manufacturing activity. The business activity index came in at 3.8 vs expectations of 5.0. Nothing to panic over, but this is just more economic weakness compiled on what doesn’t look like a very robust start to the year.

1 pretty picture:

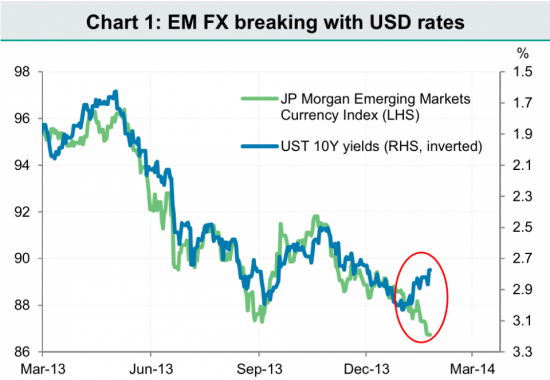

- The high positive correlation between US treasury yields and emerging market currencies could be coming to an end as investors begin to focus on the reality of low inflation in the USA and fundamental economic weakness in emerging market economies. Chart via BI:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.