4 things you should read:

- Friday was a 90/90 day and what it means – Barry Ritholtz

- 5 takeaways from the emerging market rout of 2014 – WSJ

- Money and class – Mark Thoma

- How seriously should we take the Nobel Prize in Economics? – Noah Smith

1 economic data summary:

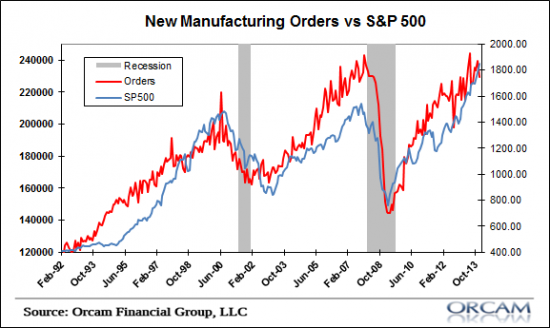

- Durable goods orders were weak in December. New orders dropped 4.3% vs expectations of a 1.6% increase. Ex-transportation was down 1.6^ vs expectations of 0.1%. New orders are a fairly good leading economic indicator so this doesn’t bode particularly well for manufacturing.

- Consumer confidence came in at 80.7 vs expectations of 79. The US consumer doesn’t seem to care much about any signs of economic softness seen thus far in January.

- The Case/Shiller housing index came in at 13.7% year over year. This data lags a bit and isn’t consistent with other housing data we’ve been seeing which has been very soft. I would expect the future monthly readings here to better reflect that softness.

- Richmond Fed Manufacturing came in at 12 vs the consensus of 10. That was down marginally from 13 in December. Manufacturing appears to be slowing some in most regions though not by alarming amounts just yet.

1 pretty picture:

- Durable goods and the S&P 500 tend to correlate well with one another. The recent weakness in durable goods orders could be a sign that the stock market has gotten a bit too optimistic about future economic growth.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.