4 Things Worth Reading:

- NON Correlation does not equal Negative Correlation – Attain Capital

- Challenging the Consensus – Absolute Return Partners

- A Field guide to stock market corrections – Josh Brown

1 Data Summary:

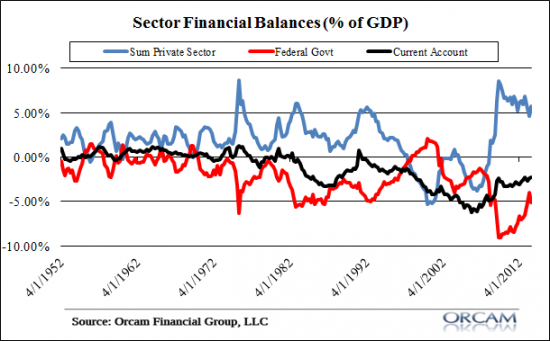

- According to the CBO, the Federal budget deficit is expected to decline again this year as tax receipts are expected to grow 9% versus spending growth of just 2.6%. The deficit’s reduction is largely the result of private sector healing from the credit collapse.

- CoreLogic reported 11% year over year growth in US housing prices. This is down from the recent months, but remains a very high historical level of growth. The slowing rate of change is consistent with much of the soft housing data we’ve seen recently.

- Factory orders fell by 1.5% in December after poor aircraft orders and computer orders dragged the index down. There were some signs of strength in the broader index, but the poor results in durable goods seem to confirm some of the data we’ve seen lately. Manufacturing is easing.

1 Pretty Picture:

- The federal budget deficit helped play an important role during the last 5 years as the government’s spending and issuance of net financial assets helped to offset the de-leveraging that was occurring in the household sector. As you can see in the chart below, the government’s spending contributed to the non-government’s saving. And as the private sector has healed the deficit has been reduced as tax receipts have increased. This is a sign that our economy is returning to some sense of normalcy.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.