4 things worth reading:

- Most ‘Medieval’ – PIMCO Investment Outlook by Bill Gross

- What Might ignite global contagion? – WSJ

- Zulauf on Global Economy: “Another Deflationary Episode” – Brazilian Bubble

- How the New Classicals drank the Austrians’ milkshake – Noah Smith

1 data summary:

- ADP reported private payrolls of 175K, which was better than the consensus estimate of 170K. This is well down from the December figure of 227K and likely points to another modest gain in Friday’s NFP report.

- The ISM Services report came in at 54 which was much better than yesterday’s manufacturing report. This was a gain vs last month’s reading of 53. Employment was higher at 56.4 and new orders were just marginally higher at 50.9.

- The global composite PMI from JP Morgan came in at 53.9 which was essentially flat versus last month’s reading of 54. This likely doesn’t reflect the recent turmoil in emerging markets, however.

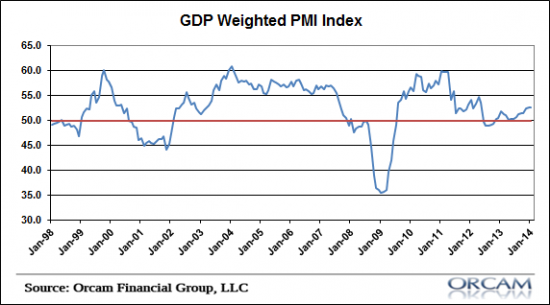

1 pretty picture:

- The Orcam GDP Weighted PMI came in at 52.7 which was up just slightly versus last month. The trend is only marginally positive at this point, but positive nonetheless.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.