4 items worth reading:

- Prasad vs Pettis on the Future of China’s Growth – Bloomberg Brief

- The bear thesis from two notable market bears – Advisor Perspectives

- Euthanasia of the rentier – Krugmaster P

- The Big Mac Index says the Rupee is undervalued and the Norwegian Krone is overvalued – The Economist

1 data summary:

- The FHFA House Price Index came in weaker than expected with a 7.6% year over year increase in prices. The real estate market is definitely slowing off its torrid pace from last year.

- Jobless claims are a continuing bright spot for the economy and came in at 326K this week versus expectations of 330K. This is still consistent with an expanding labor market and remains one of the best real-time economic data points.

- Chicago Fed National Activity Index came in much weak at 0.16 vs last month’s reading of 0.69. The weakness was led by employment and production.

- Flash PMI for the US came in at 53.7 vs expectations of 55. The weakness was led by a slowing in new orders, output, employment and backlogs. The weather was cited as a major contributing factor.

- Existing homes sales came in at 4.87mm units. The market was looking for 4.9mm. Again, real estate appears to be slowing some as 2014 begins. Last year’s torrid pace of activity is simply unsustainable.

- The Index of leading economic indicators softened from 1% to 0.1%. It looks like muddle through is here to stay for now.

- China PMI came in at 49.6 – the first contraction in 6 months. The global economy is still relatively weak.

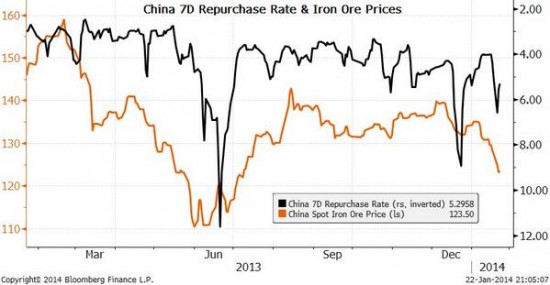

1 pretty picture (via Michael McDonough):

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.