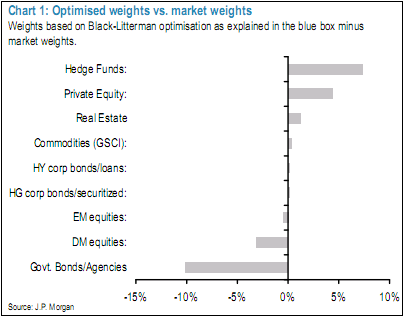

On the back of GDP cuts (to 1.4% in Q1) and concerns over excessive optimism with regards to estimates, JP Morgan has moved to a more defensive posture in their recommended portfolios. According to their latest weightings they are now overweight hedge funds, private equity, real estate and commodities (via JP Morgan):

Assets to own in a market volatility (12%) portfolio

- Underweight government-related bonds: Our total return projection of 0%-1% for this universe justifies a large underweight, even after taking into account the low marginal contribution to risk that this sector has within a global portfolio. In our optimized portfolio we recommend an allocation to government bonds that is 8% below market weights (chart 1).

- Overweight Alternatives: The main counterpart to the underweight in government bonds is a large overweight in Alternatives. Our optimal portfolio has a total overweight of 14% in Alternatives driven by HFs, Private Equity and Real Estate. The weight of HFs in particular, at 10%, is almost 8% above their market weight.The main driver of our portfolio optimization results stems from the fact that these alternative asset classes, especially Hedge Funds, have low Marginal Contribution To Risk (MCTR). Chart 2 shows that the MCTR of Hedge Funds is only 6%, only modestly above the 4% MCTR of government bonds. And this is after using more volatile investable HF indices (i.e. HFRX indices) in our optimization process.

Source: JP Morgan

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.