The guys over at Pundit Tracker have put together a pretty little update of the Barron’s Roundtable Pundits. Some of the pundits are very well know, but don’t have public track records. So their “guru” status leaves some wondering whether it’s truly earned. But here’s a nice tracker of their public calls over the last 10 years. The returns aren’t risk adjusted and most of the sample sets each year are too small to adequately judge, but I was intrigued to see Marc Faber and Felix Zulauf at the top of the list. These are smart guys (even if a bit hyperbolic at times) who generally have some pretty interesting ideas to offer. Here’s more via Pundit Tracker:

For a full breakdown of the 2012 picks, click here.

The pundits collectively are slightly underperforming the S&P again in 2012 (9.1% vs 10.0%). Mario Gabelli has been the top performer, thanks to several 65%+ gainers: Fortune Brands Home & Security, Cincinnati Bell, and Gaylord Entertainment. Marc Faber has continued his spectacular performance, with his emerging market bets paying off in spades. Meanwhile, Abby Joseph Cohen and first-time Roundtable member Brian Rogers have both turned in 15%+ gains so far. On the negative side, Felix Zulauf — who had been the best of the group through 2011 — has had his first sub-par year, as his bearish macro take has failed to play out yet in the markets. Finally, Fred Hickey’s recommendation of Marvell Technology has sunk him to the bottom of the rankings.

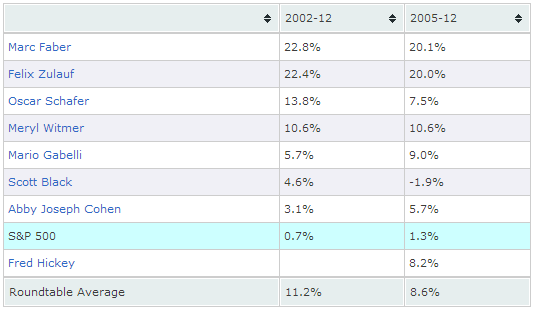

Here are the updated compounded annual return figures for the periods 2002-12 and 2005-12 (Hickey joined in 2005), with Faber now edging out Zulauf over both time periods:

Updated CAGRs (incorporating 2012 YTD figures)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.