Warning – this is going to piss half of you off and make the other half think I am a Trumper. Sorry to disappoint all of you in advance.

There’s been a lot of angst and finger pointing in recent weeks about the downturn in the stock market. The easiest target, and the most vocal, has been Donald Trump. I think I’ve been pretty balanced with Trump over time. I said he wasn’t responsible for the 2017 stock bull market and while I’ve poked some fun at him here and on Twitter and derided him over the years for talking about the stock market I really don’t think we can blame him for this downturn.

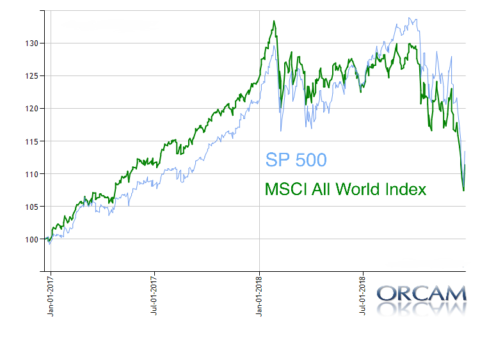

You might be wondering why I think this? Well, this all started long before most Americans think it did. Yes, this downturn started way back in January when global stocks peaked. Have a look for yourself.

You see, the deceptive part about this downturn was, in the USA, the S&P 500 kept ticking higher over the summer of 2018 while global stocks had peaked and mostly continued to flatline or move lower. But the correlation here was still 90%+. In other words, global stocks started turning south long before Donald Trump went on a series of Twitter tirades.

And that’s the problem with the “Trump made the stock market crash” narrative – if he made US stocks crash then he must have also made the entire global stock market crash. Does anyone really believe the President of the USA is the main influencing factor in global stocks?

Now, I am not saying that he didn’t influence it at all. I certainly think his trade deals have been silly and most of his chatter about the stock market should be halted by his advisors. But at the end of the day the stock market is a great big place made up of tens of thousands of entities. The President in the USA might influence these entities to some degree, but he isn’t causing them to operate the way they do and in the long-run that’s what really matters here.

I think we have to be careful injecting politics into our investment discussions. Deriving an investment position from a political position is, in my opinion, the easiest way to ruin a portfolio and inject behavioral biases into your portfolio.

NB – You might be wondering why I think the stock market did turn down. Honestly, I don’t know, but as I said at the beginning of last year the high returns of recent years were unsustainable and likely to moderate in the coming years. The era of high and safe returns is over. So, why did stocks fall? Because in order for them to rise in the long-term sometimes they need to fall in the short-term. That’s just how this works and our political narratives rarely have much to do with how that all happens.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.