I made some comments on Twitter yesterday regarding Turkey and the interest rate hike that the CBRT implemented to try to stave off crisis. The comments didn’t include much detail (the whole 140 character thing is limiting) and I don’t think my point came across very well. So I wanted to elaborate a bit….

It looks like we’re back in “crisis” mode. That is, every time a little problem flares up somewhere in the world everyone immediately assumes 2008 is coming back and this is the coming of the next “big one”. The current crisis du jour is the problems in Turkey where we’re seeing classic balance of payments crisis precipitated by poor government policies, pegged currencies, asset price boom and excessive debt. I think Turkey is an appetizer to what could potentially be much larger problems.

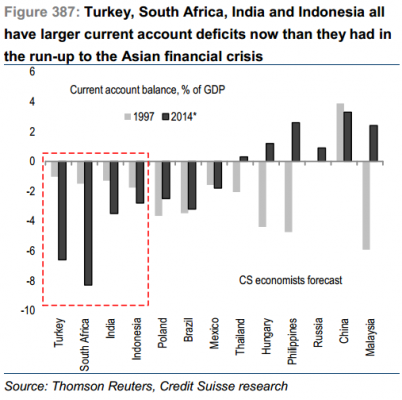

The current problems are not all that different than what we saw during the 1997 Asian Financial Crisis. The big difference is that the key players in this crisis are not only running much larger current account deficits than they were in 1997, but they’re simply more important economies. The following chart via Cardiff Garcia at the FT shows the comparison of the key players relative to 1997:

In my view, it’s not Turkey, South Africa or Indonesia that should concern us all that much. It’s not that these countries aren’t substantial, it’s just that the problems driving the crises in these nations could also drive much more important countries into crisis. In a lot of ways, this is like looking at the Euro crisis. It’s not Greece that’s really that concerning. It’s Greece leading to problems in Italy, Spain or another key player that would break the floodgates. And in this case, what we have is a group of countries that have experienced asset price booms, overinvestment and overvaluation of assets via various forms of financial intermediaries which has coincided with growing current account deficits and potential currency crises. And the lynchpin in much of this is China because they’re the driver of much of the foreign demand that has driven the booms in these countries. In other words, so goes China so goes these emerging markets.

But we shouldn’t panic just yet. As Pawel Morski noted, this is hardly a “crisis” just yet as there are few signs of domestic debt problems. After all, if we start to see real contagion we’ll likely see credit spreads in emerging markets begin to blow out more broadly. That’s not happening just yet:

In my view, the countries to keep close tabs on are India, Brazil & Australia. All three are intricately connected to Chinese growth, have had substantial asset price booms, substantial current accounts deficits and are 2-3X as large as Turkey. If contagion becomes a real concern it won’t occur through Turkey. It will occur through China, but it will leak out to countries that are substantially larger global growth components. Just one more reason to steer clear of emerging markets in 2014….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.