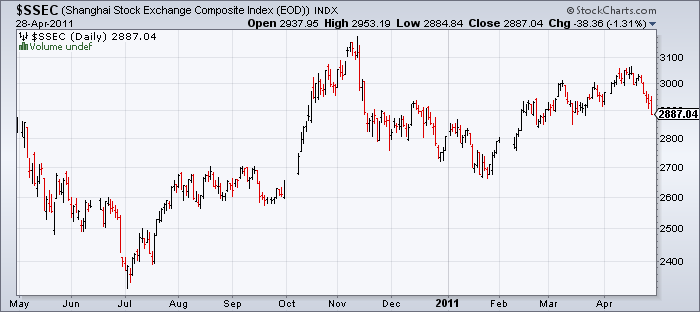

While the markets have continued to melt higher on the hopes of perpetual Fed easing and “better than expected” earnings, some interesting divergences are occurring. In particular, copper prices and the Shanghai Composite are in retreat. The Shanghai Index has proven to be a particularly good leading index in recent years. While the recent divergence is short-lived it is worth keeping an eye on. Slower growth in Asia would be foreshadowed by their equity markets (which have a very high correlation with commodity prices and copper in particular) and as I’ve continually said – slower growth in Asia would be very troubling for a western world that is barely gripping onto a sustainable recovery.

The Shanghai Composite is down 5% in the last few weeks

Copper just can’t seem to catch a bid in this raging commodity bull market

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.