Good comments here from the Bank of Canada brought to our attention via David Rosenberg’s morning note. They discuss the significant malaise in residential real estate and put the effect of this drag into perspective for the US banking sector:

“The U.S. banking system has recovered markedly since the crisis (Char t 12), as suggested by the results of the 2012 U.S. bank stress test. However, the recovery is still being hampered by the continuing malaise in the residential housing market. Banks in the United States have maintained the same level of exposure to residential real estate—around 40 per cent of their total loan books—since 2006.

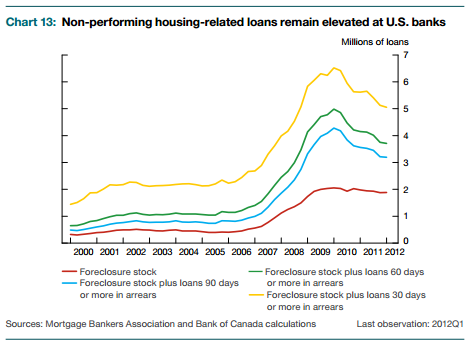

The housing market has remained weak since December, and house prices are about 30 per cent below their pre-crisis peaks. About 10 per cent of housing-related loans are either delinquent (i.e., 30 days or more in arrears) or in some stage of foreclosure (Chart 13). In addition to non-performing housing loans, U.S. banks hold a sizable number of “real estate owned” (REO) properties, which are part of the U.S. shadow housing inventory.

REO are properties that are associated with defaulted mortgages and that have not been disposed of following foreclosure proceedings. At an estimated 400,000 units, the volume of REO properties was broadly unchanged over the second half of 2011.

The number of REO properties is strongly influenced by developments in housing activity and prices. If the housing market remains soft (or worsens), an increasing number of the currently delinquent mortgages would default. At the same time, banks would find it difficult to sell defaulted properties at favourable prices. This would lead to a rise in the REO properties held by banks.”

If my outlook for housing is right (a standard post-bubble “work out” period with no “bottom” event) then this drag should remain a risk for many years to come.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.