One of the more valuable concepts I’ve developed over the years is the idea of price compression. Price Compression is an explanation for market bubbles that says the markets can, at times, rationally (or irrationally) price in more, in the short-term, than they are likely to produce in the long-term. This temporal inconsistency creates a disequilibrium in prices because the underlying asset cannot deliver the cash flows in the period of time that its price currently reflects. In other words, many years worth of cash flow is presently bid into the price of the asset creating the potential for a disequilibrium.

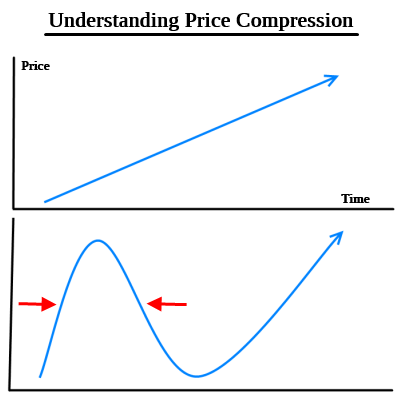

This can be seen in the figure below. If we look at the two charts below the asset reaches the same final price in the same period of time. But the bottom price chart shows a compression occurring as investors price in the final result in a very brief period of time. This compression does not change the long-term fundamentals of the underlying asset, however, investors price-in much of the change inside of a short time period thereby resulting in a potential disequilibrium over which the asset is priced.

A classic example of this is something like the Nasdaq Bubble. If we think of Nasdaq Stocks as high risk 30 year 10% per year high yield bonds then what happens when these instruments price in 50% returns several years in a row? Remember, this is an instrument that is designed to pay roughly 10% per year for 30 years. So, when it begins to pay out 50% it is quintupling its average annual payout inside of a very short time horizon. Although the aggregate tech sector is unlikely to pay out 50% per year the market is compressing the price in a manner that says this is sustainable over the long-term. In other words, the market prices in a temporal inconsistency as a long-term instrument is used as a short-term speculative vehicle whose price is derived in such a way that it cannot mathematically pay out its cash flows over the proper time horizon of the asset.

Price Compression is all about understanding the temporal constraints of an asset and the way in which it is priced over its lifetime. As a macro risk management concept it is useful in identifying assets that are potentially riskier than they otherwise would be.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.