I was watching CNN the other day when a commentator, discussing the government aid package, said that individuals were only getting $1,200 checks and the rest of the money was going to “big business”. This seems to be an increasingly popular narrative and the confusion over the aid package seems widespread. The new COVID programs are much more targeted towards Main Street than the media has been reporting. I was vehemently against the bank bailouts in 2008 and thought that they didn’t help Main Street nearly enough. These programs are very different.

There’s a lot going on here and the confusion is understandable so let me see if I can unravel this mess and help us all better understand it.

CARES Act and Fiscal Policy (government spending).

The CARES Act and fiscal policy include the support funds that are part of government spending as a result of the economic decline. We’re specifically separating the Federal Reserve’s policies here to correctly distinguish monetary policy from fiscal policy.

Automatic Stabilizers – Let’s start with one of the biggest and least discussed components of government support – “automatic stabilizers”. This is automatic government spending that responds to economic weakness. For instance, tens of millions of people will get unemployment benefits in the coming months. The national average unemployment benefit is $1,540 per month. The federal government added an extra $2,400 for up to 16 weeks and extended base benefits from 26 weeks to 39 weeks. So, an unemployed person will get at least $15,750 over the next 4 months PLUS the $1,200 for a total of $16,950. The $1,200 check was only part of the overall CARES Act and is a very small part of the overall benefit that individuals will receive. This narrative going around that individuals are getting nothing is extremely misleading.

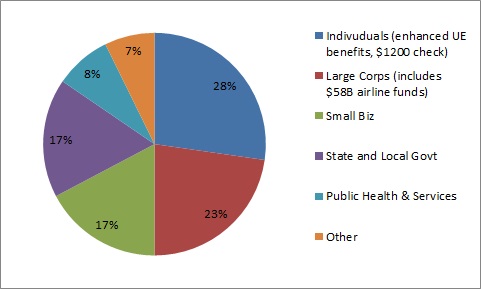

CARES Act Distribution

The $2.2T CARES Act was widely touted as a “bailout” of big businesses because some of the distributions included controversial payouts to entities like airlines. This is also wildly misleading. In fact, 75% of the funds are being disbursed to individuals, local governments, public services and small businesses. Here’s the general breakdown:

The Federal Reserve and Monetary Policy

The Fed has been VERY active in recent weeks in large part because Congress was so slow to act. The Fed operates with a great deal more discretion and can operate much more swiftly because of this discretion. They’re also a very controversial entity because they operate through the banking system and people hate banks and Fed Haters will pretty much always criticize their actions because they hate all interventions in the “free market” (free market isn’t a thing, but that’s a different discussion). Anyhow, the Fed’s programs are actually targeting Main Street so let’s break it down.

Many of the distributions in the CARES Act went to the Fed to help support their various lending facilities. This allows the Fed to take smaller distributions from the Treasury and multiply them into lending facilities to help a much broader component of the economy. Let’s discuss some of these programs.

Exchange Stabilization Fund (ESF) – This is technically a Treasury fund that was funded via the CARES Act and will distribute funding to support many of the following Fed lending facilities.

Quantitative Easing (QE) – Ah, the big bad “money printing” program from the 2008 crisis that really doesn’t do much of anything. This time around they’ve committed to $700B in purchases of T-Bonds and Mortgage Backed Securities. This will swap Central Bank reserves for bonds in what is nothing more than a change in the private sector’s composition of assets, not necessarily an increase in those assets. This program really irks people and also doesn’t really do as much as people think.

Primary Dealer Credit Facility (PDCF) – The Fed is just a big bank and operates through the banking system and their Primary Dealers (large banks that essentially make markets for the Fed’s operations). This facility is an open-ended facility that was used in 2008 and repaid in full. It helps support operations like QE.

Commercial Paper Funding Facility (CPFF) – The commercial paper market is a short-term funding market for corporations. This is primarily for short-term funding needs like payroll. The Fed obtained $10B from the CARES Act to help support this market up to $100B. This will help stabilize these short-term markets and help corporations better meet their short-term funding needs. Like most of the facilities listed below it is an indirect way to help Main Street mainly by supporting payroll and short-term funding needs.

Money Market Liquidity Facility (MMLF) – The money market is another market for short-term credit that helps individuals and businesses manage short-term cash flow needs. If you have a brokerage account your “cash” actually sits in a money market fund. It’s designed to be stable and settle at par every day. The Fed’s MMLF program will help support these markets so there are no disruptions. This is also a $10B distribution from the CARES Act.

Primary Market Corporate Credit Facility (PMCCF) & Secondary Market Corporate Credit Facility (SMCCF) – These programs will help fund and support corporate bond markets via a $85B distribution from the Treasury. Roughly 2/3rds of the funding is for the PMCCF and and 1/3rd will go to the SMCCF. Part of the SMCCF is being used to purchase ETFs, an understandably controversial program and in my opinion something they shouldn’t really be doing.

Term Asset Lending Facility (TALF) – This one’s also a blast from the past. The asset backed market is a credit market for lending based on collateralized asset backed markets. It’s predominantly corporate and consumer lending based. The Fed will help support this market via a $100B program.

Paycheck Protection Program Liquidity Facility (PPPLF) – This Fed facility will help support lending via the Paycheck Protection Program. This collateralizes loans via the PPP and helps support further lending to small businesses.

Main Street Lending Program – This program will providing short-term lending to small and medium sized businesses via two $600B facilities. This is also designed to help businesses maintain their short-term funding needs.

Muni Liquidity Facility (MLF) – This is a $500B program to purchase the bonds of state and local municipalities to help support their short-term budget needs.

The real meat of the Fed’s programs are targeted at helping corporations and local governments meet their payroll and short-term funding needs. The full size of the program isn’t known just yet, but they will dwarf the Treasury’s programs by trillions. There’s a lot of good in these programs and they will help support a lot of small, medium and local business in addition to state and local governments.

The bottom line is that these programs are much more targeted at Main Street than the 2008 Bank Bailouts. Yes, there are controversial parts to this stuff (like the Fed buying high yield bond ETFs), but there’s also a lot of good going on here. There are many people selling the narrative that this entire aid package is bad just because small components of it are imperfect. I don’t find these to be fair critiques of the overall package.

Anyhow, I hope you all are being safe and healthy and that you found this summary helpful in understanding what’s actually going on here.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.