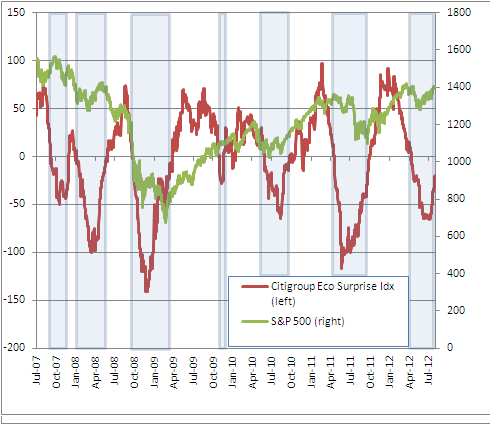

Just an indicator update here since I know a lot of people have been asking about this one lately – the latest reading on the Citigroup Economic Surprise Index is consistent with an environment in which analysts are still proving too negative on most of the economy data (via Macquarie Private Wealth):

“One indicator we like to watch is the Citigroup economic surprise index that aggregates all material or market moving economic data relative to consensus. It has been turning its way towards the positive after being negative since April. Generally speaking, numbers above zero have been good for the equity indexes. The latest reading is -19.7, after being as low as -65 in late July. The Euro area surprise index has also been faring better, although the recovery has not been as abrupt. The anecdotal evidence would suggest this as well… we are reading far fewer stories about the imminent US recession.

But the equity markets continue to get very little respect. The S&P 500 is 1% away from its highs since the recovery began in 2009. And 10% from its all time highs set in 2007. No questioning the volatility, but the trend has been moving higher.”

Source: Macquarie

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.