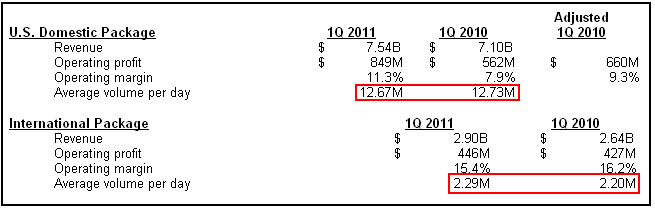

UPS reported another solid quarter this morning proving that the global economy remains on relatively solid footing. The strength of this recovery, however, remains somewhat uneven. As international growth (led by Asia) remains strong the domestic market showed some softening. This can best be seen in their average volume per day. Year over year growth was down marginally in the USA, but grew at a 4% pace internationally.

This environment remains strong enough to generate decent top line growth and strong earnings. While the domestic recovery remains somewhat shaky it is still my opinion that China and Asia remain the lynch pin to global recovery and earnings strength. Any weakness in the Asian economies would be most worrisome.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.