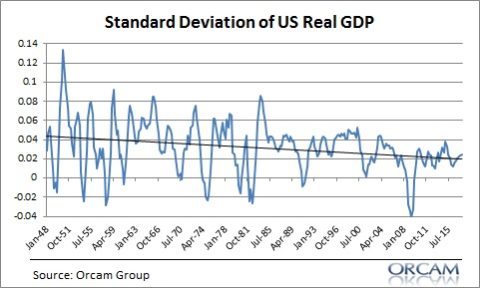

I was reviewing yesterday’s Z.1 release from the Federal Reserve and all I could think to myself was “man, this is all so boring.” Boring is good in economic terms. It means there are no outlier sectors doing weird stuff that can create future instability. But this is all part of a broader theme that I’ve talked about regularly here – the US economy is becoming increasingly stable.¹

Now, I know what you’re thinking – “Cullen, we’ve had two stock market busts and a financial crisis in the last 20 years!” This is true. But it’s important to remember that the financial markets aren’t the economy and the data underlying the economy shows that this economy has been incredibly stable even with the Nasdaq bust and the financial crisis.²

In the era of “new normal” and “secular stagnation” narratives almost no one is talking about how stable the US economy is. Yes, we’re growing more slowly than we have in the past, but we’re doing so with increasing stability. This is the portfolio management equivalent of generating lower but more stable returns. In other words, it’s as if the US economy is doing better by growing more slowly but with greater stability.

But what could be causing this? I have a few ideas:

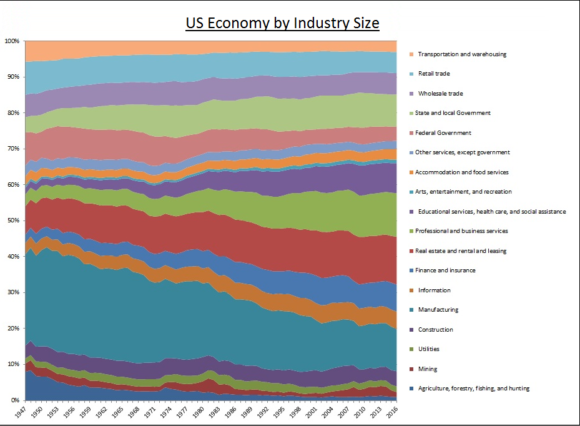

1. The US economy has become much more diverse. The US economy has become much more diverse over time which has reduced its dependency in any specific industry. Here’s a look at how the USA used to be a mostly manufacturing economy and has transitioned into a highly diverse economy that isn’t dominated by any single industry:

(Click for Larger Image)

2. The Government plays a bigger role than ever. While the Federal Government has become a smaller part of the overall economy our state and local governments are significantly larger. This has likely contributed to slower growth, but has also added stability to jobs and income over time as government jobs tend to be more recession proof than private industry jobs. Overall, this has acted as a greater safety net to the aggregate economy.

3. The Federal Reserve has become more involved in the economy. The Federal Reserve has become an increasingly involved entity in the US economy as the financial and real estate sectors have grown and private credit creation has become increasingly integral to stable growth. This has been most evident in the mortgage industry where the stability of mortgage debt and mortgage markets in general has become increasingly important.

4. Growth in international trade and importance as a reserve currency issuer. The US current account deficit has expanded over time as the US economy has become an increasingly important reserve currency issuer. This growth in international trade has further diversified domestic markets and helped the USA become less dependent on domestic demand.

5. Relative peace time. Much of the volatility in the global economy in the early and mid 1900s was due to the series of World Wars that disrupted the global economy. The current period of relative peace has dampened the rate at which the global economy and the US economy have fluctuated.

It’s an interesting topic for our times. While many people continue to think that the US economy is suffering some sort of terminal decline I view it more like a big boring value firm that will probably never grow like it did when it was a non-diverse emerging market. But the trade-offs are arguably superior. After all, slower, but more stable growth should not necessarily be viewed as worse than high and unstable growth.

¹ – See, “Secular Stagnation or Golden Era of Low and Stable Growth?”

² – Statistically, one could argue that the 2008 financial crisis was an event that was so traumatic that it reflects an economy and an environment that is becoming less stable. That is not unreasonable, but I am assuming that such an event is more an outlier than the norm. To argue that, for instance, the period from 1980-2018 has been unstable because of one large anomalous event is not representative of the entire 40 year period of increasing stability.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.