Europe has been saved, right? Not so fast. The recent “fixes” in Europe are all coming at the most opportune of times. The global economy is overcoming fears of a double dip and banks are eager to purchase sovereign debt on the back of generous ECB guarantees. But the bigger problems remain. Europe’s trade imbalances will persist as the single currency continues to wreak havoc on the region. And austerity will continue to result in weak economic output and unsustainable sovereign debts. And at the end of the day the thing that frightens bond investors is the long-term sustainability of the periphery countries to overcome their budget goes (the trade imbalance and lack of growth will feed this beast). Given the continuing austerity it’s unlikely that the periphery nations will be able to fix their budget woes without fiscal aid.

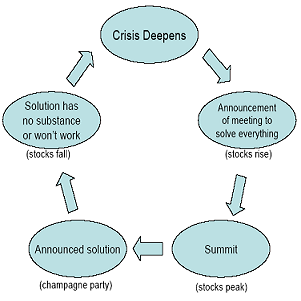

In his latest investor letter David Einhorn provided us with a nice visual of how this crisis keeps repeating itself. We move from announcement to announcement with fears being alleviated and then re-emerging as budget woes come back to the forefront. He summarized it as such:

“The market embraces these announcements as eagerly as the media, behaving as if any and all communication is equally constructive, and likely to yield a solution. The market continues to rise until the day of that summit, as all ears await a Grand Communique. Within minutes of any proclamation, the market may cheer with a final, celebratory spike. Upon evaluation of the actual statement, it becomes clear that either nothing has truly been agreed upon, or the plan is insufficient, impractical or just won’t work. The market sells off and the crisis deepens some more. Lather. Rinse. Repeat.”

Einhorn states the 2012 might be the “fall of the Euro” and the 2012 catastrophe that the Mayans predicted. I still don’t think this is even remotely on the table. The Europeans are moving (inching) towards greater unity and will not allow a sovereign default to ravage the area as Lehman brothers did to the USA. But that doesn’t mean the pain in Europe is over. If anything, their lack of greater action (moving towards fiscal union or creating a permanent and sustainable financing mechanism) means the crisis is likely to re-emerge after the “champagne party” ends…

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.