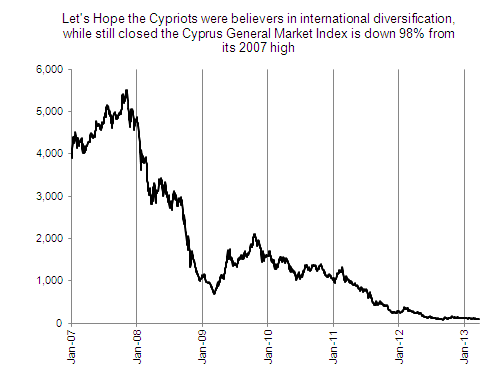

If rising stocks in the USA are a “wealth effect” then I guess we can call the Cypriot stock market’s 98% collapse a “poverty effect”, right? Unfortunately, they’re not the only market that has been slammed in recent years thanks to involvement in the single currency system.

Here’s the sad reality of the peripheral poverty effect:

- The Spanish stock market is 50% off its 2007 highs and hasn’t budged since joining the Euro.

- The Italian stock market is down 60%+ since its 2007 highs and is negative since joining the Euro.

- The Portuguese stock market is down over 60% since its 2007 highs and is flat since joining the Euro.

- The Greek stock market is down over 80% since its 2007 highs and is negative since joining the Euro.

- The Cypriot stock market is down 98% from its 2007 highs.

(Cypriot Stock Market – via Macquarie Private Wealth)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.