Is this a VoxSplainer or VoxFailure? The new VOX cards are intended to simplify and explain important news topics. But when it comes to QE this one looks like a fail. Matthew Yglesisas writes:

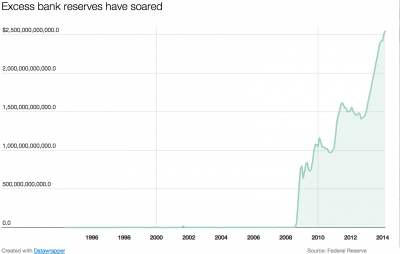

“One reason for [the low inflation] is that even though lots of money has been created, a lot of it is simply parked at the Fed. Banks are required to hold reserves — that is money that they don’t lend out — as a regulatory matter. But lately they’ve been holding lots of extra reserve money:

This stockpiling of excess reserves may be happening in part because the Fed now pays interest on them.”

He goes on to say:

“Paying interest on excess reserves could be a useful way for the Fed to in effect suck money out of the economy if it becomes worried about inflation in the future. No investment on earth is safer for banks than parking money at the Fed, so the higher you make that interest rate the more money banks will park. Money that is parked is not being loaned out and spent. So by inducing banks to park their money, the Fed can put the breaks on the economy and stop inflation.”

This is all supply side thinking. Yes, banks need to find creditworthy customers and remain solvent themselves. Therefore, bank lending is supply constrained in one sense, but bank lending is primarily demand driven. This idea of the money multiplier or that banks “lend out reserves” implies a false causation starting with the central bank and implies that the central bank can just force banks to multiply up their loan books. This is false as has been explained recently by the Bank of England.

And with regard to IOER and QE – I don’t know where this myth came from about how IOER was induced to control the money supply and entice banks not to lend out reserves. Yes, it’s true that banks won’t lend in the overnight market at a rate below the IOER, but in the aggregate banks don’t “lend out” reserves in the interbank market so that concept doesn’t apply to the broad money supply. Instead, the Fed paid IOER so it could expand its balance sheet and put a floor on the Fed Funds Rate. They explain this here with great clarity:

“3. Why is the payment of interest on reserve balances, and on excess balances in particular, especially important under current conditions?

Recently the Desk has encountered difficulty achieving the operating target for the federal funds rate set by the FOMC, because the expansion of the Federal Reserve’s various liquidity facilities has caused a large increase in excess balances. The expansion of excess reserves in turn has placed extraordinary downward pressure on the overnight federal funds rate. Paying interest on excess reserves will better enable the Desk to achieve the target for the federal funds rate, even if further use of Federal Reserve liquidity facilities, such as the recently announced increases in the amounts being offered through the Term Auction Facility, results in higher levels of excess balances.”

The payment of IOER helps set a floor on the overnight rate, but it doesn’t stop banks from expanding their loan books if there is demand for loans. This myth that banks aren’t lending because of the IOER is more supply side and money multiplier style thinking that misleads people.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.