On Wednesday the Fed will release a very boring statement. It will basically say:

“The economy kind of stinks still, but it’s gotten a little tiny bit better. But we changed our statement a little tiny bit in order to communicate the fact that our views have also changed a little tiny bit. But in reality nothing has changed all that much….”

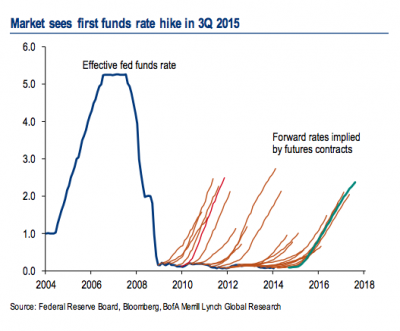

The media and the markets will likely overreact to the FOMC statement, but just remember this picture when you consider whether the Fed will actually make any drastic moves in the near-term (via Josh Brown):

That chart shows the expectations of Fed rate hikes at various times over the course of the last 5 years. In essence, the bond market has had this wrong all along. Predictions about rate hikes will be headline news tomorrow and Wednesday and dozens of talking heads will fill up space debating this. Ignore them. Wednesday’s statement will say nothing new and any overanalysis will be largely meaningless. We’re just not at a point in the cycle where the Fed can realistically raise rates….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.