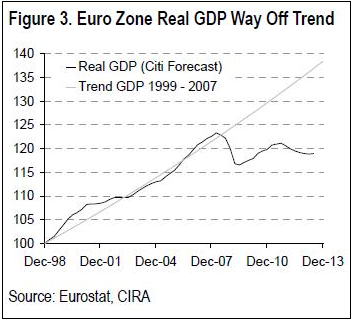

Here’s an amazing statistic on the balance sheet recession in Europe via Neil Hume at FT Alphaville. Not even in Japan did the economy stagnate like it is in Europe. And what’s the difference? fiscal policy in Japan was enough to maintain GDP growth. And as we all know now, austerity continues to ravage European economies (via Citi):

“Our economists believe the sovereign debt and banking crises are causing a renewed recession in the Euro Area. Beginning in 4Q 2012 [Sic], they forecast real GDP to contract for 6 consecutive quarters. It is expected to be an especially protracted recession. Not even in Japan, during its lost decades, did real GDP decline for 6 consecutive quarters. Our economists’ Euro Zone forecasts imply real GDP will be some way below the trend established during the first 10 years of Euro inception (Figure 3) and not get back to previous peak levels for many years to come.”

And the Japan comparison is shown below. You can clearly see (via Richard Koo) that GDP was actually maintained during their prolonged balance sheet recession. Yes, the economy was by no means strong, but it also wasn’t a depression as we’re now seeing in some European countries.

It’s really amazing that we now have near factual real-time evidence of the damage that austerity causes during a balance sheet recession and yet we still have leaders who can’t come to grips with these ideas. We’re all masochists now!

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.