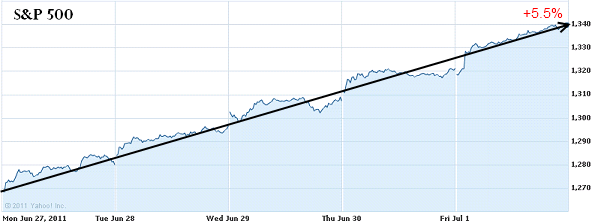

When I said that investors were excessively negative last week I never could have imagined that this would occur. The S&P 500 shrugged off more debt ceiling fears, a potential Greek insolvency, weak economic data and rallied a full 5.5% on the week. The S&P 500 rallied a full 70 points in just 5 days as shorts were caught flat footed and investors realized that the economy wasn’t going to come to a grinding halt.

Mr. Market is certainly looking manic these days. The recent swing back to a fully bullish position will almost certainly result in an excessively bullish posture in the coming weeks. But for now, the US economy can head into the weekend with an early gift before the 4th of July. Enjoy it. As is the case with Mr. Market, his happy sentiment never lasts forever….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.