Commodities are notoriously difficult to value which is why commercial traders have a huge demand to hedge and also why many commodity traders prefer to use technical analysis. Commodity price ratios use technical analysis to provide a glimpse into the historical perspective on prices. This gives the trader a 30,000 foot view of the relative value of commodity price changes over long periods of time.

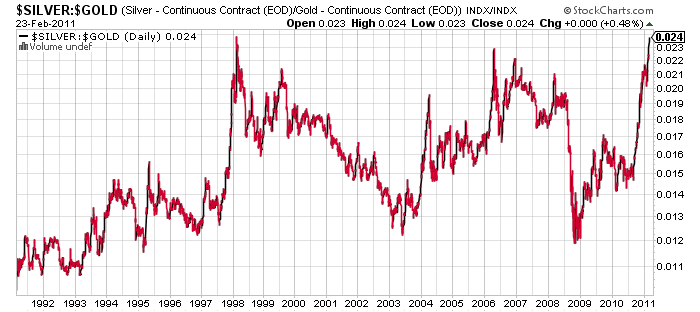

While no commodity is a perfect substitute of another it can be helpful to see how closely correlating commodities perform over long periods of time. This rather simple technique can also provide valuable insights into pairs trades and just generally avoiding grossly over/undervalued positions. For instance, a trader who is interested in being long precious metals might find the following silver:gold ratio helpful. The recent surge in silver prices has created an unusual divergence in the two metals. While a trader might not be inclined to short silver and go long gold, this same trader might conclude that gold is a better relative value long position:

Silver looks expensive compared to gold

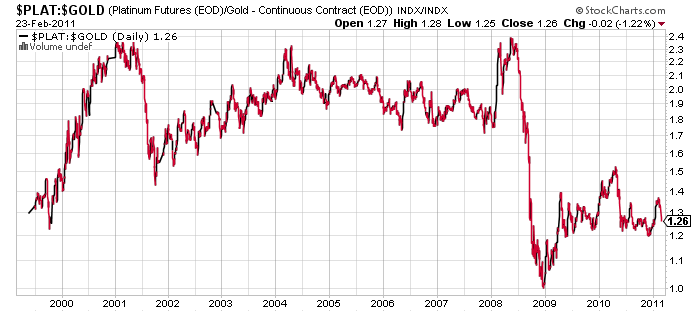

Platinum looks moderately inexpensive compared to gold

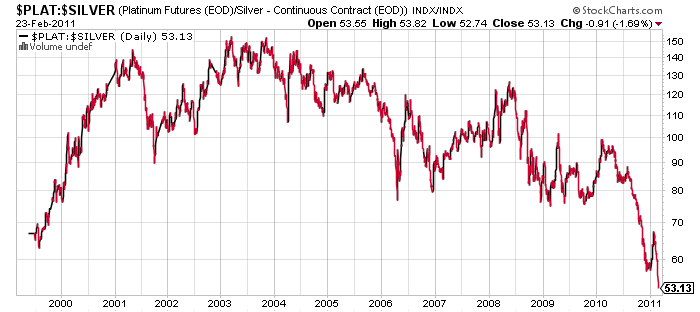

Platinum looks inexpensive compared to silver

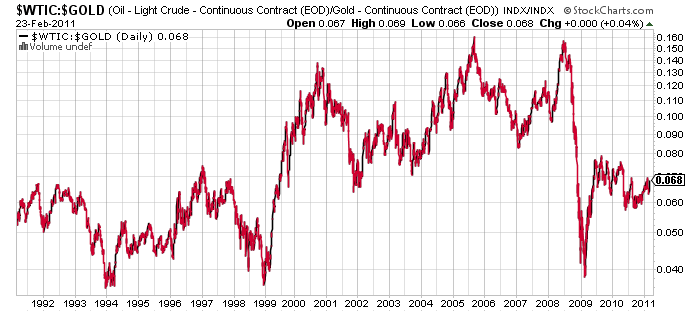

Oil looks fairly valued compared to gold

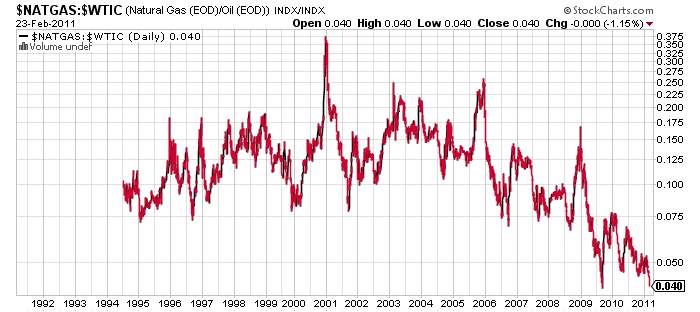

Natural Gas looks inexpensive compared to oil

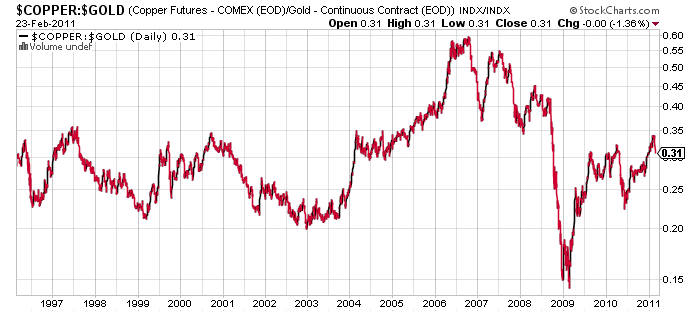

Copper looks fairly valued compared to gold

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.