I pride myself on being a truly low fee investment advisor, financial planner & portfolio manager. With fees ranging from 0.1%-0.35% my firm offers one of the most competitive fee structures in the entire investment business. We could probably charge the standard 1% annual fee, but I made a conscious decision when I started my retail asset management business last year that I was going to get way ahead of the puck on this one for several reasons:

- I honestly don’t believe investment advisory and financial planning services are worth 1% of total assets. The idea that someone with $1,000,000 should be forking over $10,000 a year to me strikes me as disproportionately high. You very likely don’t pay $10,000 a year for your doctor, your accountant, your lawyer or

your personal trainer so why should I charge clients the equivalent of 1% per year for investment advisory?

your personal trainer so why should I charge clients the equivalent of 1% per year for investment advisory? - High fees destroy your real, real returns. An important aspect of understanding real, real returns is understanding the destruction that high fees can cause. A recurring 1% fee will substantially reduce your long-term returns.¹

- Future returns are likely to be lower. I suspect that returns will be lower in the future which means that I would be doing my clients a disservice if I charged them 1% fees. For instance, we know that high valuations are consistent with lower future returns. Additionally, we know that bond yields are at historical lows. Therefore, your average balanced portfolio is very likely to generate lower future returns than many people are accustomed to when bond yields were higher and stock valuations were lower (as they were over the last 30 years). I could be wrong about this, but if I am not then it would be disproportionately detrimental to my client to be taking 1% of what is likely to be just a 6-7% return in a balanced portfolio.²

- High fees are antiquated. With all the low fee options available today the days of the high fee asset manager are numbered. The simple reality is that technology and talent is pushing the high fee manager out of the business. No one, literally no one, needs to pay 1% or more to get very sound financial advice today.

I am writing this largely in response to a highly critical piece by Tony Robbins on LinkedIn. I don’t intend for this to sound personal, but the reality is that Tony’s just not an expert in money or finance so he probably doesn’t know what it means to be “low fee” in today’s rapidly shifting advisory landscape. This post is more broadly aimed at high fee asset managers who sell their active or “passive indexing” approach as being low fee when it’s really just a different type of high fee service. Robbins asserts that a reasonable fee is something lower than 1.25% per year (not including underlying fund fees). We should be very clear about this. Robbins is not advocating low fee asset management services. He is advocating a fee structure that is actually 26% higher than the average investment adviser fee of 0.99%.³

So, what does it mean to be “low fee” investment adviser and financial planner? In today’s world where there are a multitude of Robo Advisory firms offering all-in costs of 0.25%-1%, Vanguard at 0.3%-0.5%, Schwab at similar rates and great RIA shops like Rick Ferri’s Portfolio Solutions offering a 0.37% fee structure, I would argue that anyone paying more than 0.5% all-in is paying more than they should be. The asset management & financial planning world is changing fast. Fee structures in the 1%+ range are antiquated and unnecessary. It’s time to make fees great again. Err, make fees great for the first time ever, that is. And the only way to do that is to eliminate the 1% fee structure and follow the lead of the Vanguards and Portfolio Solutions of the world.

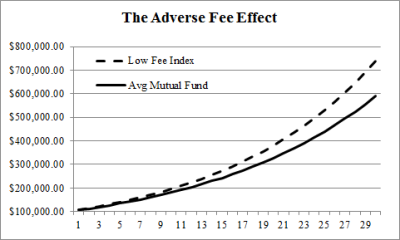

¹ – To put things in perspective consider that the average mutual fund charges 0.9% relative to the average low fee index which charges 0.1%. That’s a 0.8% difference. It doesn’t sound like much, but take a 7% compound annual growth rate on $100,000 and extend that over 30 years. Just how much of an impact does it make? The mutual fund ends up with a balance that is 23% lower than the index. In other words, the mutual fund could just mimic the return of the index and reduce your return by $150,000. See my piece on Real, Real Returns, Fee Edition for more detail.

² – See the basic math on a balanced portfolio here.

³ – See the PriceMetrix report on the state of retail wealth management.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.