When I wrote my popular paper on the monetary system (which is now, to my shock, ranked #7 all-time on SSRN) I specifically wrote it with the “modern” monetary system in mind. But what does it mean to be a “modern” monetary system? It’s a strange and interesting question that I always find myself pondering when I travel. Traveling to other spots in the world is so interesting because no two economies or monetary systems are ever quite the same. And certain places in the world always expose the not-so-modern parts of some economies.

I’m currently in Belize on a short trip and I can’t help but think about all the ways that the Belizean economy is very much undeveloped. The aspect that most stands out is their payment system. It lacks most of the sophisticated banking that we see across the states. The system is very much a cash transaction economy. And a cash based economy still looks a lot like a metallic based economy (like the gold standard). That is, the “money” that dominates exchange is an exogenous asset to the private sector.

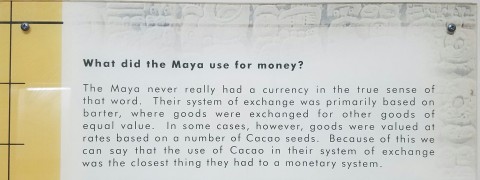

In ancient Mayan times the dominant medium of exchange was Cacao seeds. Yes, while exploring some ruins in San Ignacio I managed to find the only nerdy monetary fact in the city:

Commodities are always “outside money” because they are a net asset to the private sector since they are no one’s liability. Cash is very much the same to the private sector because its distribution is controlled by “outside” forces (usually the government in a cash based economy). Therefore, cash acts as an exogenous form of money. I call cash, coins and commodities “outside money” in my paper because they have no corresponding liability inside the private sector.

The aspect that makes a “modern” monetary system “modern” is the move towards “inside money” as the dominant form of money. That is, we don’t use outside forms of money to dominate trade. We’ve created private forms of money that go beyond the limitations of our natural resources or bureaucratic whims. In this system we have an intricate relationship of private accounting and contractual relationships that dictate how stable that money is. Government is an important component of this (for instance, in regulating the contracts via the court system), however, the supply of money is largely dictated by “inside” forces. Inside money is endogenous meaning that its quantity is controlled by the private sector in accordance with the private sector’s needs.

And what’s most interesting about this system of “inside money” is that its market-based development has resulted in a more stable form of money. That is, you tend not to see big hyperinflations in credit based inside money systems because the market controls its supply as it needs. The quantity of credit in the economy can grow and contract over time, but will tend to grow in accordance with the productive needs of the private sector. After all, much of the growth in inside money is tied directly to productive endeavors like business borrowing, investment and real estate. As a result, most of the money created in the economy tends to be used more productively than it is in an outside money system where outside forces dictate the quantity and (often) the productive utility of that money.

So, I guess we can say that the thing that makes money “modern” is the extent to which the private sector wrestles the economy of money away from outside forces and creates its own endogenous money system in accordance with market forces.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.