Global economic bellwether FedEx reported earnings today and provided us with a pretty good overview of the state of things. Here’s the key pieces of the earnings report:

FedEx is revising its earnings guidance practices to focus on full fiscal year projections with quarterly updates. For fiscal 2014, the company projects earnings per share growth of 7% to 13% from fiscal 2013 adjusted results. This assumes the current market outlook for fuel prices, U.S. GDP growth of 2.3% and world GDP growth of 2.7%. Capital spending for fiscal 2014 is expected to be approximately $4 billion.

“We remain focused on improving margins and returns in all of our businesses. The pace of that improvement is expected to be moderate in fiscal 2014 and then accelerate in fiscal 2015,” said Alan B. Graf, Jr., FedEx Corp. executive vice president and chief financial officer. “Our profit improvement program is progressing, but we continue to see the effects of customers selecting lower-rate international services. FedEx Express will further decrease capacity between Asia and the United States in July.”

The big takeaways:

- FedEx capital expenditures were down 11% year over year. In other words, corporations aren’t loosening up that much and I think the FedEx perspective is a good indicator of broaders trends.

- Easing fuel prices reduced costs by 9%. This is a definite tailwind.

- Revenues were up 4% and inline with 12 month performance. In other words, we don’t see a definitive trend in revenues through they’re definitely down from several years ago.

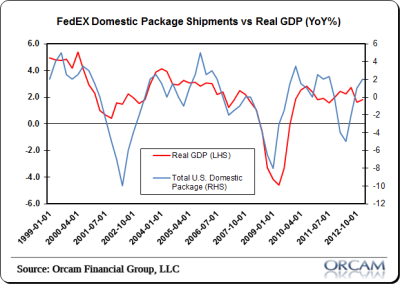

- Total US domestic package delivery was up 2%. I think that’s pretty indicative of a weak economy.

- All in all, this seems consistent with a weak economy, but not a contracting economy.

Chart via Orcam Investment Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.