I know I am the only one who thinks this, but earnings season starts for me when FedEx reports their results. It’s always a few weeks before Alcoa and in my opinion, it’s infinitely more important and indicative of the state of the global economy (as well as the domestic economy).

Today’s report can be described as just okay. The highlight (or lowlight I guess) is the reduced guidance and negative outlook due to international economic weakness:

FedEx projects earnings to be an adjusted $1.90 to $2.10 per diluted share in the fourth quarter and an adjusted $6.00 to $6.20 per diluted share for fiscal 2013 before charges related to the company’s business realignment. Costs of the benefits provided under the voluntary buyout program will be recognized in the period that eligible employees accept their offers, predominantly in the fourth fiscal quarter. Including the third quarter costs, the company now expects the fiscal 2013 pretax cost of the voluntary buyout program to range from approximately $450 million to $550 million in cash expenditures, or $0.89 to $1.09 per diluted share, with some additional costs expected in fiscal 2014. Actual costs will depend on employee acceptance rates. Including the business realignment costs, earnings are expected to be $0.94 to $1.34 per diluted share in the fourth quarter and $4.91 to $5.31 per diluted share for fiscal 2013. This guidance assumes the current market outlook for fuel prices. The capital spending forecast for fiscal 2013 is now $3.6 billion, compared to $3.9 billion in the company’s previous forecast.

In last year’s fourth quarter, the company reported earnings of $1.99 per diluted share, excluding a $0.26 per diluted share non-cash aircraft impairment charge at FedEx Express. Including this charge, earnings were $1.73 per diluted share.

“Our lower-than-expected results for the quarter and reduced full-year earnings outlook were driven by third quarter international revenues declining approximately $100 million versus our guidance primarily due to accelerating customer preference for lower-yielding international services, lower rate per pound and weight per shipment,” said Alan B. Graf Jr., FedEx Corp. executive vice president and chief financial officer. “We expect these international revenue trends to continue. We have other actions under way beyond those already included in our profit improvement program. Some of these additional actions may involve temporarily or permanently grounding aircraft, which could result in asset impairment or other charges in future periods.”

Here’s some more commentary from the conference call:

“On the economic front, our forecast calls for modest growth in the global economy. Historic revisions and incoming data since our last earnings call led us to adjust our GDP and industrial production numbers. Our U.S. GDP growth forecast is 2% in calendar ’13 and 2.5% in calendar ’14. For industrial production, we expect growth of 3% in calendar ’13 and 3.5% in calendar ’14.

Housing and auto markets have shown improvement, e-commerce experienced mid-teen growth rates and we’ve seen some inventory restocking taking place in the near term. Our global GDP forecast calls for 2.3% growth in calendar ’13 and 3% in calendar ’14. The calendar ’13 outlook certainly remains uncertain due mainly to policy issues in the U.S., Europe and China.”

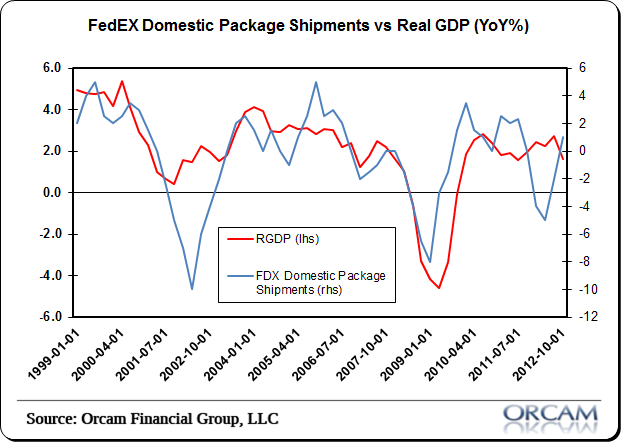

Domestic package shipments, which correlate well with real GDP in the USA, jumped back into positive territory at 1% which is historically consistent with sluggish RGDP of about 2%. All in all, it’s not great and it’s not terrible. It looks like muddle through is here to stay for now.

Chart via Orcam Investment Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.