People often ask me:

“What’s the point of owning bonds with interest rates so low?”

I’ve heard this question for most of my career and while the risk profile of owning bonds has changed, they still serve the same purpose in a portfolio that they always have:

- To provide you with stability when you most need it (usually when the stock market is declining).¹

- To provide you with some income that makes them superior safe haven assets when compared to cash.

As I’ve explained before, this is as true in a low rate environment as it is in a high rate environment. In fact, if you’re a bond holder holding bonds with the proper time horizon (holding bonds to maturity) then you actually want rates to RISE because then you can rebalance your bond portfolio into higher income generating instruments.

RISE because then you can rebalance your bond portfolio into higher income generating instruments.

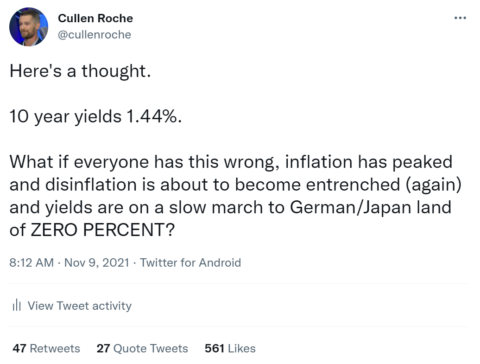

But what if rates don’t rise? What if the inflation that everyone is currently worried about doesn’t persist? What if the USA looks a lot more like Germany and Japan than Zimbabwe or Argentina? In other words, what if long-term interest rates in the USA are on a slow march to ZERO PERCENT? This is a fairly contrarian view at this point, but far more likely, in my opinion, than something like hyperinflation.

The basic theory is this:

- Yes, fiscal policy combined with Fed intervention causes inflation (in the short-term).

- Every time they step off the gas with fiscal policy the suffocating secular deflation trends of tech growth, globalization, demographics and inequality reinforce the downward trend in inflation and interest rates.

- The economy slows, the Fed and Treasury respond at some point with some more intervention.

- Rinse, wash, repeat as the secular trends suffocate these government interventions.

If rates were to continue their secular trend eventually towards 0% the 10 year Treasury Bond would earn a 15.5% total return. Not bad for a 1.45% yielding instrument with the highest credit quality in the world. Of course, smart asset allocation isn’t an all-or-nothing endeavor. We don’t need to choose to hold only hyperinflation hedges OR deflation hedges. We can choose to hold a diverse array of assets that protect us regardless of what happens.

I’ve stated many times in the last few months that this might be the single most confusing investment environment in history. Which is why we shouldn’t discount any potential scenario – including one where long-term interest rates go to 0% and bonds end up outperforming most other asset classes.

¹ – I am a big advocate of using bonds as a form of insurance in and around retirement to help increase predictability of returns during this highly unpredictable transition period for retirees.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.