(Sorry for the radio silence here. It’s been a crazy couple of weeks between this whole new dad thing, the global pandemic, running a business, STILL building my house and eating my way through the lockdown. Hopefully life starts to normalize a bit now and I can find more time for writing!)

I always describe the stock market as a temporal conundrum. What I mean by that is that the stock market is basically a perpetual instrument whose future cash flows are unknown so its price movements end up looking like a series of random guesses about the future. Sometimes it makes overly optimistic guesses and sometimes it makes overly pessimistic guesses. But on average it gets those prices pretty close to “right”.

This is wildly different from something like a AAA 1% 1 year CD, an instrument whose income and time horizon is damn near certain so you don’t get crazy principal changes across time. I’ve always said I like to think of the stock market like a 30 year high yield bond with a 6-7% coupon. You can be fairly certain what the instrument will pay out over several decades, but good luck guessing what it will do in any given day, month or year because no one knows how that 6-7% will get paid out across time.

More importantly, this “conundrum” becomes exacerbated at times as the stock market ebbs and flows as it becomes excessively optimistic or pessimistic about the future. For instance, in 1999 you could argue that the stock market was overly optimistic about the short-term impacts of the Internet. So future prices were bid way up in an unsustainable manner that resulted in a bubble that was detached from short-term reality. Or, in 2009 prices collapse as investors begin to price in a 1929 style economic outcome and future prices get pulled into the present and eventually recover as that unsustainably negative expectation fails to materialize.

That brings me to the current environment. One which people seem to resoundingly believe is manipulated by the Fed or detached from economic reality. Yes, I get it. And I agree to some degree. The stock market doesn’t look all that attractive by many measures. But what if the stock market is exactly right about what is going on? What if it’s just pulled that temporal conundrum way into the future like it does at times? Let me elaborate.

So, we came into the year expecting more of the same – benign growth, but stable. Then the COVID meteor hits. Prices collapse. Great Depression talk was rampant. The stock market undergoes its fastest downturn ever. Then things start to improve. China’s COVID cases disappear. Italy’s cases slow massively. The USA’s cases peak. The government fires a huge bazooka at the economy. And suddenly, the Great Depression 2.0 scenario starts to look pretty wrong. Prices stablize. Then start going up. And prices just keep going up. And up. And up. And here we are.

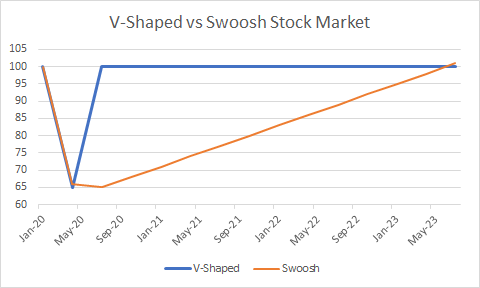

But consider this. What if the recovery is basically priced in? What if we got our v-shaped stock market recovery which pulled recovery style prices into the present and now prices more or less flat line in the future (see figure 1)? What if, unlike a 2009 style “swoosh” market recovery, we just got that recovery much more quickly? In fact, this is what happened in 1919 during the Spanish Flu. Stock markets collapsed 25% then recovered quickly and were dead money for a few years before the Roaring 20’s really took off.

Could the same thing be happening here? I think so. And if I am right then two things can be true:

- The stock market and bulls have been exactly right. The recovery is coming and the stock market already sees it.

- AND the stock bears are right that the stock market looks like a fairly unattractive asset class at present because it’s priced many years of future expected cash flows in already.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.