The idea of risk is a rather confusing and nebulous concept in modern finance. The traditional textbook definition of “risk” is standard deviation or volatility. This is convenient for academic purposes because it allows us to quantify risk in a portfolio. But this is a flawed concept for several reasons:

- Volatility isn’t always a bad thing. In fact, volatility with a positive skew is a good thing. No one complains about a portfolio allocation that rises 20% per year and falls 5% every once in a while, but this is a volatile position relative to many portfolios.

- Negative skew can be a good thing in a portfolio. For instance, many forms of insurance have a natural negative skew and detract from returns, however, it would be bizarre to argue that this is always a bad idea even if you don’t have to use the insurance.

- Investors don’t live in a textbook world and don’t necessarily judge their portfolios by the academic concepts that drive the way many portfolio managers assess their portfolio performance. This can create a conflict of interest between the investor’s perception of risk management and the asset manager’s perception of risk management.

For most investors the “risk” of owning financial assets is not having enough financial assets when you need them. This arises primarily from two factors:

- Purchasing power risk.

- Permanent loss risk.

Permanent loss risk occurs when your savings is declining in value and you’re forced to take a loss for some reason (emergency, behavioral, short-termism, etc). Purchasing power risk is the potential that your savings does not keep pace with the rate of inflation.

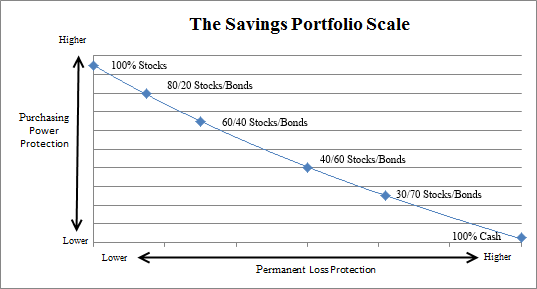

In order to visualize how one might protect against these risks in a portfolio it’s helpful to view this concept on a scale showing how our savings can be allocated across different assets:

The investor who wanted to be protected against permanent loss risk would be 100% cash, however, they would risk falling behind in purchasing power by the rate of inflation each year. Likewise, the investor who wanted to be protected against purchasing power risk would be 100% stocks. A balanced portfolio will tend to protect against these risks somewhat evenly and in my experience investors tend to be more worried about protecting their savings from permanent loss than Modern Finance often implies. Viewing the world thru the lens of this Savings Portfolio Scale will provide investors with a much more realistic and balanced perspective of how market risk applies to their actual savings.

Related:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.