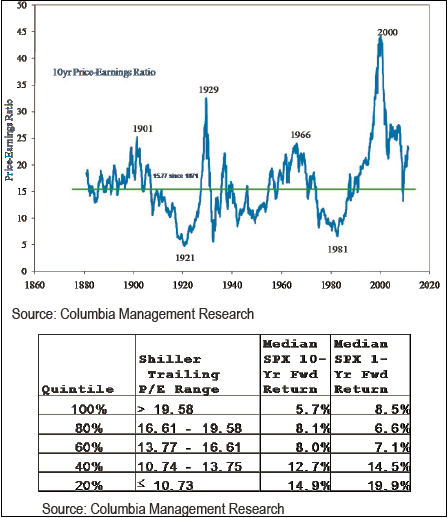

We had quite a debate about the usefulness of the Case/Shiller PE ratio a few weeks ago (see here for a good summary). Some enlightening data comes from Anwiti Bahugana, Ph.D. & Senior Portfolio Manager at Columbia Management with regards to the Case/Shiller PE and future returns (courtesy of Business Insider). She writes:

“A general rule of investment proclaims that one must buy low and sell high. We tested this hypothesis using Shiller’s P/E as a guide for market’s cheapness. Using data from 1872 onwards, we rank ordered P/Es and divided them into valuation quintiles. The most expensive quintile had valuations of more than 19x and the cheapest quintile with valuations less than 10x. As expected, buying stocks when valuations are the cheapest does indeed provide the best returns over the next 10 years. However, buying stocks when they are in the two uppermost (i.e., expensive) quartiles also returns about 6-8%. Results are about the same when we look at returns over the next 12-month period. Average returns are about 6% and median about 8%.”

Very interesting conclusions. Even at extreme levels the market has continued to generate decent returns. Of course, this data is extremely skewed by the Nasdaq bubble, however I think the lesson is clear – expensive markets can stay expensive for a long-time. Timing the exact exit point can be difficult to say the least. And the tipping point for the Case Shiller index appears elusive at best.

In essence, stocks are expensive now, but that doesn’t necessarily mean they can’t generate decent returns. More importantly, one must consider the environment we are in. As I noted in December, almost all valuation metrics are stretched, but that’s been the case for 20+ years. Until the Bernanke Put comes off the table these extended valuations are likely to be with us. Whether QE2 is the beginning of the end of the Fed’s coddling of financial markets is impossible to know, but my best guess tells me it is not. This Fed intently believes in protecting banks and markets. It’s likely that the Bernanke Fed will be remembered for its keen market focus as opposed to its keen focus on real economic growth.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.