The Nasdaq is down 14%. The S&P 500 is down 9%. Even the gold standard of portfolios, the 60/40 is down 7%. They’re not catastrophic numbers, but they’re fairly sizable given that we’re only 27 days into the year. At this rate the Nasdaq will be at $0 by July. Just kidding. That’s not how that works. But still, it’s an uncomfortable environment. So what should we do? Here’s a quick check list:

1. Revisit your financial plan and goals.

A lot of people will overreact during market corrections for one simple reason – they don’t have a plan in place. All asset allocation should start with a simple financial plan so you create goals and time horizons for specific assets. I’ve personally become a huge fan of simple bucketing strategies using ETFs because they create behaviorally robust and streamlined asset/liability matching portfolios. What that means in short is, you want to have specific buckets for specific time horizons to match your future liabilities. For instance, everyone needs a liquidity bucket for emergencies, home down payment, etc. And everyone has medium term liabilities for more uncertain future liabilities like kids tuition, car purchases, etc. And then we all have long-term buckets like retirement and long-term health needs. Creating time horizons for your assets will help you stomach the probability that that asset will be there in full when you need it to be there.

At any rate, you need to establish a plan and the worst time to establish your plan is after the market falls and you realize you needed the plan years ago.

2. Revisit your max pain point.

I always tell people that the worst time to discover your risk profile is when you can’t afford to discover it. This too often happens when the market is spiraling lower and people panic. They move to cash because cash makes the pain stop. If you don’t know your risk profile the market will teach it to you. Do not wait for that moment. Instead, assess your max pain point before you get there.

you get there.

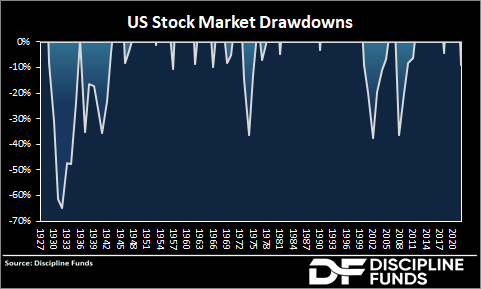

The best way to do this is to ask yourself how you’d feel if your portfolio fell 20% over the course of a calendar year. And then assume it’s going to fall another 20% the following calendar year. At this point your portfolio is down 36% so you need to ask yourself how you’ll feel when it falls ANOTHER 20% in year 3. This brings you to a total drawdown of 49%. This is essentially what happened in the 1970s and early 2000s. It’s not unheard of by any means even though it is a distant memory.

In a raging bull market like the last 10+ years it’s easy to forget what a horrible grinding bear market really feels like. They’re scary as hell and they’re a perfectly normal part of the market cycle. But it won’t feel normal when it’s happening.

Now, everyone knows how to answer the question “what do you do in this environment?”. Everyone says buy more or sit tight. But when you’re in the throes of that 49% downturn you will, with near certainty, question every emotion you’re having. You will, with certainty, say “what if it’s different this time”. And you will be tempted to sell to make the pain stop.

Do this exercise now. Put yourself in those emotions now so you don’t discover them later.

3. Remember that perfect is the enemy of the good.

We all want the perfect portfolio. That’s the portfolio that captures all the upside and none of the downside. News flash – that thing doesn’t exist. And no matter how much you look for it you’ll just waste money on taxes and fees the harder you try. It’s in moments like this where you need to go through exercises #1 and #2 and then accept that your plan doesn’t need to be perfect. The appropriate portfolio that you can stick with will outperform the optimal portfolio you can’t stick with.

You aren’t going to capture all the upside with all the downside protection of cash. Everyone wants to hate on bonds and cash in an environment like today. But that’s mainly because they’ve forgotten what it feels like when stocks go down for multiple years in a row (something bonds and cash do not do).

The point is, implement the portfolio you need, not the portfolio you want. By setting realistic expectations and implementing the portfolio you need you’ll likely give up a lot of potential upside while implementing a portfolio that is behaviorally robust and therefore likely to perform better than the counterfactual where you chase the returns without knowing you’re chasing risk.

4. Talk about it.

People don’t like to talk about money. Or, they like to talk about money when things are good, but hate to talk about money when things are bad. Own your mistakes. Talk about them. Learn from them. There’s nothing wrong with talking about your mistakes, getting second opinions and having an open discourse about how you’re feeling and what you’re doing. It’s all part of the process of learning to deal with the emotional rollercoaster of the markets.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.