It must be a slow period for good economics arguments because the one raging over Japanese Government Bond prices sure looks like a lot about nuthin’!

Richard Koo says the recent move in Japanese Government Bond yields could lead to a “loss of faith in the Japanese government”. Noah Smith does the math and says Japan could be “in deep shiitake” if rates keep rising. Nick Rowe says “Bond prices have been falling (and so bond yields have been rising), as a result (probably) of Abenomics”. Paul Krugman makes a lengthy post confirming Rowe’s comments.

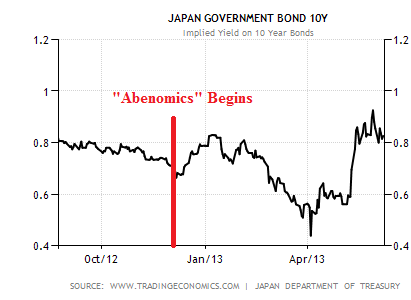

The only problem is, JGB yields are higher by about 10-15 bps since Abenomics started last year. That’s a 0.1-0.15% move in yields which takes us all the way back to where rates were….last October. I’ve tried to get people to keep the “moves” in JGBs in perspective (see here) and I don’t really see what all the fuss is over this move in yields?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.