Monetary Realism has been influenced by many schools of thought, but also contributes a unique perspective, approach and contributions to the world of finance and economics. In its simplest form, the MR approach is unique in that it just provides a set of understandings for others to analyze and build into their world view. The MR approach is based on a specific set of institutional understandings and accounting understandings. We approach the world of finance and economics in much the same way that an engineer or scientist approaches the real world – by identifying things we know to be true and then working within that reality to identify potential outcomes and impacts of certain events on the world. Monetary Realism is not necessarily a “school” of economics, but is rather a way of thinking about the world of economics and finance based on an operational perspective.

1. MR is economics and finance by market practitioners, not ivory tower theorists.

Monetary Realism was started by 4 non-economists. Through our expertise in banking, law, futures markets and portfolio management we’ve found the views of economists severely lacking in the way they actually translate from the textbook to the real-world. Monetary Realism, to a large extent, is an attempt to reframe the economics discussions so it reflects the real-world more accurately. In this regard, we apply economics in a much more practical manner.

So much of economics is derived from policy analysts and ideologically driven views of the world. For instance, most economists have a strict policy focus. They utilize economics in order to promote a particular political view of the world backed by a specific set of policies. Policy analysts, therefore, are often unfairly biased and conflicted in their economic analysis. By focusing on economics as a practical tool for understanding the monetary system we are able to eliminate many of the biases and policy driven ideologies that lead to misleading conclusions. MR, in a lot of ways, is economics by non-economists thereby providing a perspective of the monetary system that is more open-minded and flexible. Most importantly, as Nassim Taleb would say, MRists have “skin in the game” and take great pride in being able to apply economics to the actual financial world in a useful and practical manner. After all, if economics can’t be translated into accurately forecasting and understanding our monetary world then it’s not good for much – including policy.

Historically, some of the most important insights in economics came from outside of the profession. JM Keynes, Wynne Godley, Adam Smith and Karl Marx were all market practitioners and not professional economists. We think that can be expanded upon. Economics is too important to be dominated by theorists and people who lack real-world experience. It’s time for the market practitioner to take a more dominant role in developing economics.

2. MR is designed to eliminate politics from economics using the Da Vinci Methodology.

We probably can’t completely eliminate politics from economics, but MR is based on attempting to understand the monetary system and the economy at its operational level as opposed to focusing on providing policy solutions like so many other economic schools. So we focus on things that are verifiable. For instance, how certain institutions are structured in specific monetary systems, how modern banking works, etc. It’s all based on the view that a superior understanding of the money system comes from building an understanding of how the monetary “machine” works from the ground up.

We try, as best we can, not to provide prescriptive ideas and instead try to provide a set of understandings so that users of MR’s understandings can then decide on their own how best to implement policy. We are not Keynesians, Monetarists, Austrians or any specific school at all. MR is simply a set of understandings designed to describe the money system.

Economics tends to focus on how certain policies can solve problems. I believe economists should adhere to a Da Vinci method. That is, when Da Vinci studied the human body he did not focus so much on how to fix the body, but how it worked. Economists focus too much time trying to fix the economy and not enough time building a set of principles that define how it works. If more economists adhered to a Da Vinci method I think better solutions would necessarily arrive.

This is the primary strength of MR. We don’t treat economics like it’s a religion. Instead, we treat it like an evolving and changing science that requires flexibility and an open-minded approach. As far as I know, there are few if any approaches to economics that provide this sort of approach.

3. MR has a unique description of the way the monetary system actually works.

MR took many of the understandings from post-Keynesian and other economic schools and then added a series of understandings on top of this to create a very unique view of the monetary system. This results in a perspective and a set of understandings that are relatively unique.

For instance, we would never describe the government as a “money printer” despite the fact that most mainstream economists and laypeople do so. The reason why is because we view money endogenously within the monetary system. That is, the dominant form of money is created inside the banking system due to demand from its participants. The government doesn’t actually create money at all. It uses bank money. So all government taxing and deficit spending is a redistribution of bank money. Taxes take from Peter to pay Paul and deficit spending is the act of selling a bond (a net financial asset) to Peter so the government can spend Peter’s bank deposits into Paul’s account. There is no actual “money printing” occurring in this process. For more details please see here.

In building this view by understanding the historical and institutional design of the monetary system we construct a view from the inside out and take a unique view of the monetary system that is well outside of the way most mainstream economists would describe the system.

4. Monetary Realism is a private sector theory of money.

MR uses a unique approach to understanding modern money. As money is a central component of the monetary system it’s crucial to build a solid understanding of precisely what money is. MR uses a specific description of money using a “scale of moneyness” with the focus on money as a medium of exchange issued primarily by the private sector. This is entirely different than the standard orthodox and heterodox views of money in a vertical hierarchy as issued by governments.

This brings us to a central component of MR which is the banking system and what MR calls “inside money” (money that comes from inside the money system). We focus primarily on modern banking because we view the money system as being dominated by private banks. Most modern money systems are comprised almost entirely of bank deposits that were created through the lending process. So we build our understandings of money around this all important money as opposed to building government centric models like most other schools do (or worse, ignoring banking altogether). This is an extremely unique way of viewing money as all outside money (which most economists focus on and design money multiplier or other reserve centric models around) becomes a purely facilitating form of money and not the center of the monetary universe.

Some monetary theories claim that the government gives money its viability. Although most money is denominated in a state denominated unit of account, it is private money that gives state money its viability. In other words, it is private output and the issuance of private monies that make state money viable. Within this context, state money is mainly issued to facilitate private money.

MR has also developed the concept of “moneyness” to help better understand how we think about money and the way it fits into the financial puzzle. The “scale of moneyness” is a totally unique and illuminating perspective on the financial assets we utilize in the monetary system.

See the following for more:

5. Understanding the Institutional Design of the Monetary System

MR is largely about understanding the institutions within a specific monetary system. We think many modern economists get this understanding wrong and end up placing certain institutions at a level of prominence that is misguided. The most prominent example is the Federal Reserve. While many economists and schools of thought focus on the Fed and its importance as a “money printer” or centrality to the reserve system, MR views the Fed as a facilitating entity to the banking system and an entity that merely serves as an intermediary to other intermediaries (the banks). Therefore, it is misguided to overemphasize the importance of the Fed to the real economy when its primary purpose is secondary in nature. You can read more on this here.

JKH’s Contingent Institutional Approach also provides a totally unique but sophisticated look at the current monetary arrangement and the actual design of our system.

6. Quantity Value vs Acceptance Value.

Understanding why fiat money has any value at all is paramount to understanding the monetary system. We break this down into two specific and clear definitions:

Acceptance value represents the public’s willingness to accept something as the nation’s unit of account and medium of exchange. This is largely the result of government laws and infrastructures.

Quantity value describes the medium of exchange’s value in terms of purchasing power, inflation, exchange rates, production value, etc. This is primarily the result of the quality of output produced by the total economy.

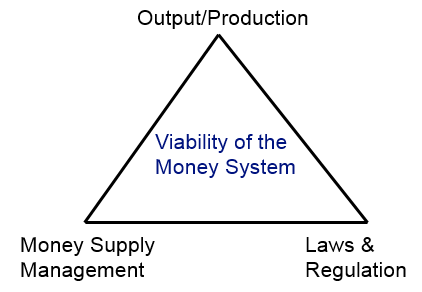

7. Understanding fiat money’s linkages to viability

We build our understanding of fiat money’s viability based on the understanding that a monetary system exists primarily for the purpose of exchanging goods and services. So the money system is inherently as good as the quality of its output. We form the linkages of fiat money’s viability using that the value of any form of fiat money is ultimately derived from three key linkages:

1. Output/Production

2. Money Supply Management

3. Laws & Regulation

All of these linkages play key roles in maintaining a stable money system.

8. MR is entirely open to other schools and their views of the money system.

Because we focus primarily on operational realities we are very open to other schools of thought and their policy ideas and thoughts. You’ll notice that MR appears as though it’s a mixture of many different schools and understandings. That’s because it is! This is the power of the unbiased operational view. There is no such thing as a set of MR policy ideas or ideologies that must always be adhered to. MRists understand that the monetary system is evolving and changing and that requires a flexible and open-minded approach to viewing the system. You’ll often notice us agreeing with Austrian economists, Keynesians, Market Monetarists, etc. One of the keys of the approach is to maintain an open-mind and open arms to other schools and their ideas. No one has all the right answers and any school that sells you their message as though they do is likely peddling something more like an ideology and not an unbiased view of the world.

9. S=I+(S-I) & The lead role of the private sector .

We break down Wynne Godley’s sectoral balances approach to provide a clearer understanding of the balance in the monetary system. Through the equation S=I+(S-I) one can clearly begin to see why private investment plays such an important role in the economy. A big part of MR is understanding the balance between agents in the economy. The monetary system exists primarily so private agents can transact business in the pursuit of better living standards. This is most often achieved when private agents are productive and providing goods and services that improve overall living standards.

Historically, we know that the economy has relied primarily on private investment for the expansion of this process. So we try to present that reality in mathematical form by showing that private saving is driven by two pieces – private investment and government. When you understand the balance of the equation you can begin to see how the private sector’s balance sheet is made up primarily of claims it has against itself in the form of things like common stocks, corporate bonds, loans, etc. All of these assets and liabilities comprise parts of a massive balance sheet that expands and contracts primarily based on how productive the private sector is. So the focus and balance should always emphasize the private sector and its lead role.

10. The government plays a facilitating role in the economy.

Although we focus on the private sector we also understand the important role that the government plays in our lives. MR is NOT an anti-government view of the world, but instead focuses on describe its current structure and role by understanding how it exists and how it has historically operated in our lives.

Unlike many other approaches, we don’t design a government centric view of the world. You’ll notice that most other economic schools like the Keynesians, post-Keynesians and Monetarists all focus on the ways the government can implement policy. We understand that the government plays an important policy role, but also like to emphasize that the government is primarily a facilitating agent in the monetary system. If we think of the monetary system as a soccer field we might say that the private sector includes most of the players trying to score goals while the governments serves a role like a referee. They determine laws, help support stability and integrity of the game, regulate the players and can have an enormous influence on the outcome of the game. Government is an extremely powerful tool that can be leveraged by the private sector to help generate growth and sustain stable growth. But it must be understood and harnessed correctly.

11. The MR Law emphasizes the importance of private production:

A big part of understanding the money system is about understanding living standards. Most economists focus their policy ideas on full employment and price stability, but there is no guarantee that full employment and price stability are consistent with improving living standards. You could easily determine full employment and price stability through a command economy approach where the government simply implements price controls and hires all the unemployed. Of course, there’s no guarantee that would lead to improved living standards. Therefore, we focus on the component of living standards that is consistent across almost all of human life – time. The MR Law states:

“We generate improving living standards through the efficient use of resources resulting in the optimization of time”

This is not to imply that price stability and full employment are not important, but when one considers the monetary system we must consider the broader scope of all the factors that can impact overall living standards. The MR Law helps bring a concise understanding to the role of output with respects to overall living standards.

12. No two monetary systems are exactly the same.

MR treats specific economic environments and monetary systems as their own unique situations. You won’t find vague generalizations in MR implying that what’s true in one monetary system MUST be true in another monetary system. This again highlights the flexibility of the MR approach to economics. In order to understand the monetary system in a specific country or its economy you must start by understanding its specific institutional structures and environment.

Most of economics is a cookie cutter approach. Schools too often imply that what works in one economy will automatically work in another. A recent example is the Reinhart and Rogoff work on sovereign debt or the ECRI’s recession call. MRists said both of these concepts were incorrect because they were not applied with the appropriate specifics necessary to understand the environment and the potential economic outcomes.

For more info, please see the following:

To obtain a better understanding of Monetary Realism we recommend the following reading (some of which is quite advanced):

1. Understanding The Modern Monetary System

2. The “Dismal Science” and Getting Back to Da Vinci’s Methodology

3. Understanding Inside & Outside Money

6. The Disaggregation of Credit

8. The Human Body, The Economy & The System of Flows

9. Understanding the Fed’s Primary Purpose

10 JKH on Saving, Investment and S=I+(S-I)

11. The Treasury and Central Bank: A Contingent Institutional Approach

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.