In finance and economics we tend to use oversimplified terms like “money” and “bonds” when the reality is that it’s important to be more nuanced in understanding these terms. That’s why, for instance, I prefer the term “moneyness” when I refer to a money-like instrument. It conveys the proper degree of flexibility about the item. Sometimes cash has more money-like properties than a bank deposit. Sometimes it doesn’t.

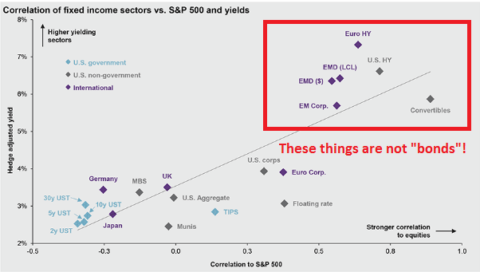

We can apply the same type of thinking to the financial markets and in this particular case I will use the bond market. Of course, all bonds are not the same. In fact, many bonds are what I would call “stocks in drag”. Here’s a nice chart from JP Morgan showing the correlation between stocks and certain types of bonds (I added the red commentary):

As I described in “Understanding Modern Portfolio Construction”, bonds play a very specific role in a portfolio – they earn a better real return than cash, but they should provide permanent loss protection when you need it most, ie, when the stock market is falling. So a well hedged portfolio should not just contain bonds, but very specific types of bonds. And this is where it’s important to acknowledge the potential weaknesses in some “passive” indexing strategies. A passive index can blindly hold the entire market portfolio where a part of that “market” is allocated in instruments that don’t actually reflect the allocation you believe you hold. In other words, you might hold more stock-like instruments than you should thereby creating behavioral risks where they can easily be mitigated.

Specifically, as you can see from the chart above, many foreign bonds and junk bonds will actually add to permanent loss risk in a portfolio relative to other fixed income options like T-bonds. And this is why it’s useful and intelligent to acknowledge the reality that we are all active investors. In other words, it’s actually smart to deviate from the global financial asset portfolio (the only true “market” portfolio) because knowing this helps you better build a portfolio that reflects your actual risk profile. And that’s half the battle.¹

¹ – Source:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.