I was struck by two posts I read yesterday. The first described the extent of the depression occurring in Greece (via Macromon):

“The Greek recession has been the most severe in the recent history of crisis and compares only to the U.S. Great Depression. Reasons include: the fear of the Euro exit; the credit crunch; aggressive and horizontal austerity; substantial reform delays; political risks; the pre-crisis structure of the economy; and the strong Euro. “

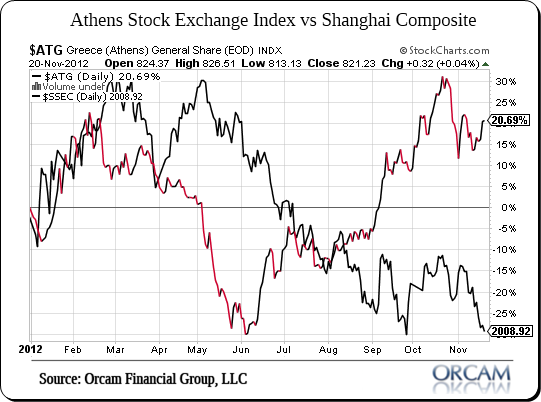

The second post really jumped out though. Greece’s stock market is obliterating China’s this year (via Also Sprach):

“Say whatever you like about Greece, at least their stock market is performing better than…China’s.

The chart below shows the year-to-date return of Greece’s Athex Composite and China’s Shanghai Composite. You are welcome to draw your own conclusions as to why the stock market of an economy which is supposedly “growing really fast” is performing even worse than the stock market of an economy which is supposed to be in a multi-year depression.”

(Chart via Orcam Investment Research)

Just more evidence that the stock market does not necessarily always represent the economy….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.