It’s no secret that the Fed’s easy monetary stance has steered many people’s opinions of the markets and has helped the economy (at least to some degree). And as Keynes once described, the market is a beauty contest so it doesn’t matter how many hedge fund managers hate QE because as long as other investors think QE is the prettiest lady in the room she’ll continue to get the market votes. If you had any doubts that QE can have a huge psychological impact then just have a look at Japan where it’s got investors tripping over one another to buy stocks at higher and higher prices.

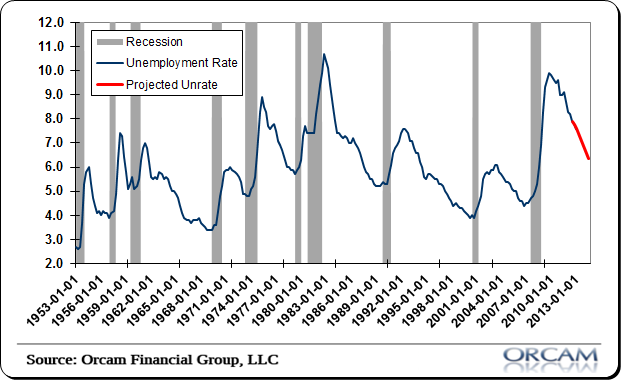

So it’s crucial to get ahead of the other voters in the contest and understand when they might start voting against QE. And that means understanding when the Fed will ease off the gas. We know one thing for certain – the Fed is going to remain accommodative until the unemployment rate hits about 6.5%.

So when will the unemployment rate hit 6.5%? As I mentioned earlier this year, we’re seeing clear signs of improvement in the labor markets. I predicted a 7% unemployment rate by the end of this year and so far that looks to be pretty much right on.

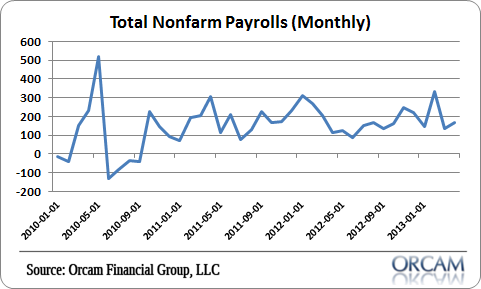

Looking ahead, we know a few things. The two big drivers of the unemployment rate have been the participation rate and the job gains. Recent trends have shown a modest decline in the participation rate as well as fairly healthy gains in jobs. Payrolls have averaged about 150K per month since 2010 and the participation rate has declined about 1/2 point per year.

If we just assume these trends continue and the participation rate declines by about 1/2 point per year and jobs continue to grow at the 150K pace they have since 2010 then we’ll see a 7% unemployment rate as soon as Q4 of this year and a 6.5% unemployment rate late summer of 2014. Of course, if the economy weakens then those are optimistic estimates. Either way, the Fed isn’t easing any time soon.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.