Pretty interesting research piece here from the San Francisco Fed. It provides an analysis of the timing of a future rate hike. You can read the whole thing here, but the conclusion is pretty simple:

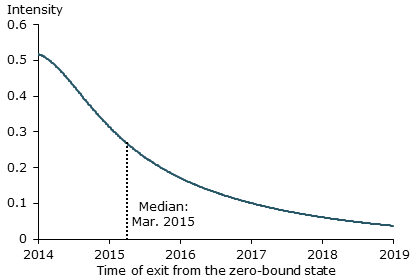

“The exit date distribution is heavily skewed so that very late exit times are significantly probable. Still, the median exit date is in March 2015. In other words, the economy is just as likely to remain in the zero-bound state at that date as to have exited before it. One takeaway is the considerable level of uncertainty about the exit date. The model suggests that there is about a one-in-three chance of remaining in the zero-bound state past 2015.”

So, despite all the “taper talk” the overnight rate is very clearly going to remain low well into 2015 in all likelihood….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.