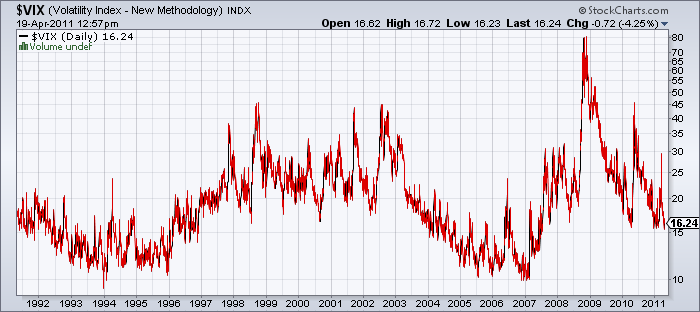

Fool me once, shame on you. Fool me twice…It looks like volatility has left the building (upon first glance). Yesterday’s dramatic sell-off hardly put a dent in the volatility index as the index spiked at the open and then quickly scooted back to levels seen just two trading sessions prior.

Buyers of volatility have been whiplashed in recent months as economic concerns have sparked only brief periods of fear. The latest 100% surge in volatility during the Japanese earthquake lasted just a matter of weeks and corrected even faster. But a short-term perspective doesn’t quite do this metric justice. Volatility, by historical standards, is still elevated. In fact, it’s still in the crisis zone. Investors haven’t let the fears of 2008 leave the building quite yet.

So, we might ask – where is the volatility? It’s right there next to you. But we’ve all become so accustomed to headlines about crisis and imminent doom that the new normal in volatility doesn’t even feel new….What might look like near-term complacency is potentially not complacency at all. Rather, it’s just another sign of the very fragile state of sentiment in the current environment and the belief that Main Street is not entirely trusting of a sustained economic recovery.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.