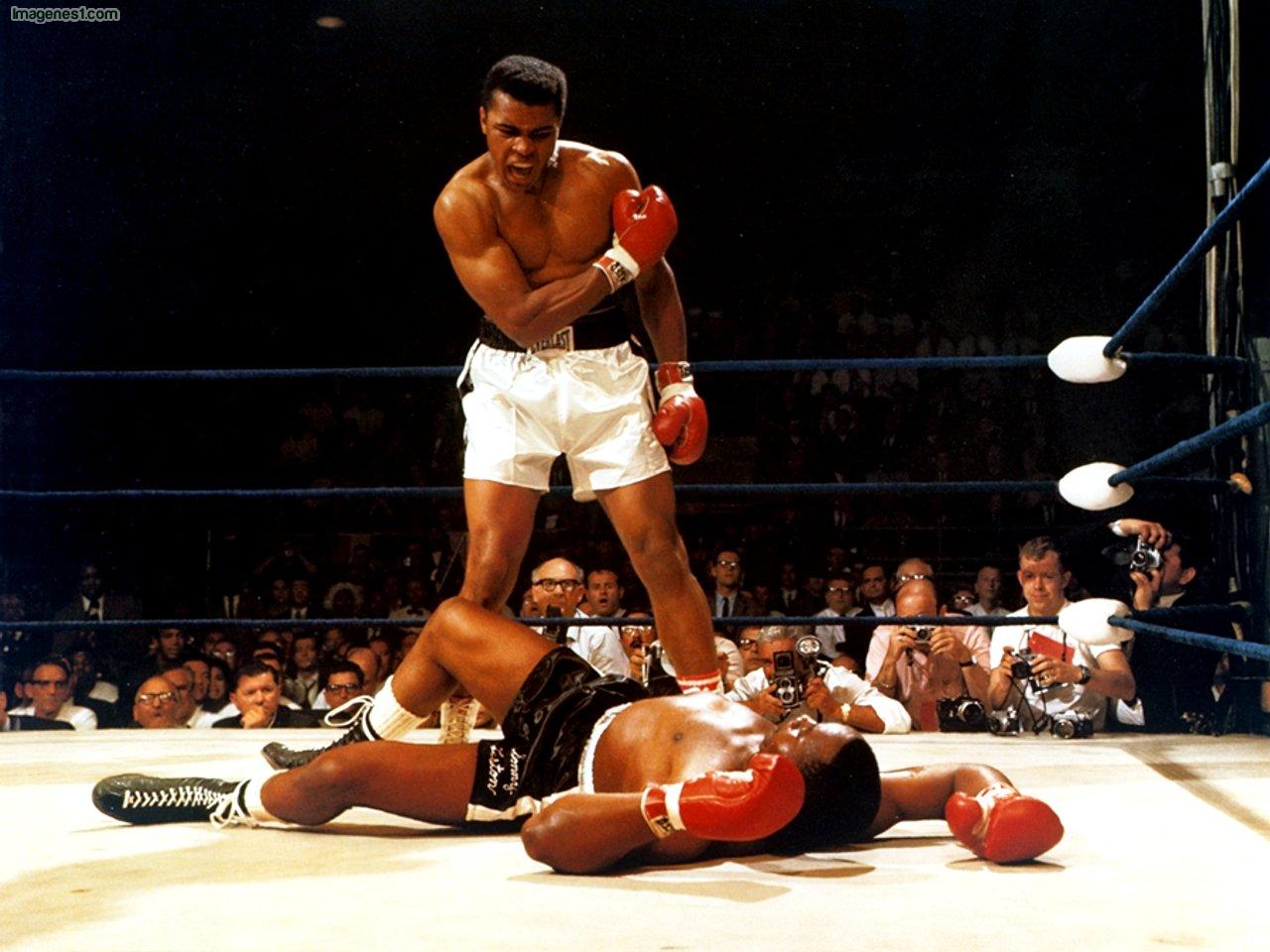

Nick Rowe wrote a nice post clarifying his view on the money multiplier discussion. And in doing so he described his view that the central bank is an “alpha bank” while the commercial banks are mere “beta banks”.* This is a very mainstream perspective. Most people tend to think of the “central bank” as being the center of money creation. But what if the “central bank” isn’t really so central? What if the central bank is actually the beta bank?

My view of the monetary system starts with a very basic understanding of endogenous money. That is, I work from the understanding that commercial banks create the thing that most of us use to transact with – bank deposits. The commercial banks issue this medium of exchange and process how it is used within the payment system that they operate. The issuance of this medium of exchange is crucial to understanding the credit cycle, the business cycle, prices, unemployment, growth, etc.

Before there was a Federal Reserve system these banks would issue debt and even created privately owned central clearinghouses that served as the model for what would eventually come to be known as a “central bank”. And this gets to the crux of what a central bank really is – it’s primarily there to serve as a clearinghouse for commercial banks. They bring interbank payment settlement into one place where this process can be streamlined and organized.

In a world of endogenous money there is no reserve constraint on how banks issue money so banks do not rely on a central bank to create money. That doesn’t mean they create money entirely free of any constraint, but they are not constrained by the amount of money that the central bank supplies to them in the form of reserves. In other words, banks create loans and find reserves after the fact if needed. If there is a reserve requirement in place then the central bank supplies reserves to the system as needed. Again, the central bank is serving the needs of the commercial banking system.

Most mainstream economists turn this model upside down and view the entire world of money through the central bank. Worse, they even remove the commercial banks from their model. But when you view the central bank as a servicing bank to the commercial banking system the concept of “alpha” and “beta” becomes very murky. In fact, it makes one wonder whether the aggregate commercial banking system isn’t the alpha and the central bank’s role is a mere beta role.

* Alpha refers to the dominant entity in this case while beta refers to the less dominant entity.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.